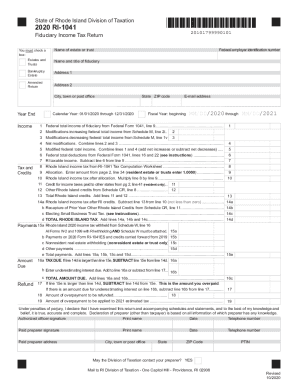

Get RI DoT RI-1041 2020

How It Works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign 15b online

How to fill out and sign Rhodeisland online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

Experience all the key benefits of completing and submitting legal forms on the internet. With our solution filling in RI DoT RI-1041 usually takes a matter of minutes. We make that achievable by offering you access to our full-fledged editor capable of altering/correcting a document?s initial textual content, inserting special fields, and putting your signature on.

Complete RI DoT RI-1041 within a few clicks by simply following the instructions listed below:

- Choose the document template you will need from our collection of legal form samples.

- Choose the Get form key to open the document and start editing.

- Submit all of the required boxes (these are marked in yellow).

- The Signature Wizard will help you insert your electronic signature as soon as you?ve finished imputing information.

- Put the date.

- Check the whole template to be certain you?ve filled out everything and no corrections are needed.

- Press Done and download the ecompleted form to your computer.

Send your new RI DoT RI-1041 in an electronic form as soon as you finish completing it. Your information is securely protected, as we adhere to the latest security standards. Become one of numerous satisfied clients that are already filling in legal documents straight from their homes.

How to edit Ridivision: customize forms online

Fill out and sign your Ridivision quickly and error-free. Get and edit, and sign customizable form samples in a comfort of a single tab.

Your document workflow can be considerably more efficient if all you need for modifying and handling the flow is organized in one place. If you are looking for a Ridivision form sample, this is a place to get it and fill it out without searching for third-party solutions. With this intelligent search engine and editing tool, you won’t need to look any further.

Just type the name of the Ridivision or any other form and find the right sample. If the sample seems relevant, you can start modifying it right on the spot by clicking Get form. No need to print out or even download it. Hover and click on the interactive fillable fields to insert your information and sign the form in a single editor.

Use more modifying tools to customize your form:

- Check interactive checkboxes in forms by clicking on them. Check other areas of the Ridivision form text with the help of the Cross, Check, and Circle tools

- If you need to insert more textual content into the document, utilize the Text tool or add fillable fields with the respective button. You can also specify the content of each fillable field.

- Add pictures to forms with the Image button. Upload pictures from your device or capture them with your computer camera.

- Add custom visual components to the document. Use Draw, Line, and Arrow tools to draw on the document.

- Draw over the text in the document if you wish to hide it or stress it. Cover text fragments with theErase and Highlight, or Blackout instrument.

- Add custom components such as Initials or Date with the respective tools. They will be generated automatically.

- Save the form on your device or convert its format to the one you need.

When equipped with a smart forms catalog and a powerful document modifying solution, working with documentation is easier. Find the form you need, fill it out instantly, and sign it on the spot without downloading it. Get your paperwork routine simplified with a solution tailored for modifying forms.

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Video instructions and help with filling out and completing 15a

We have the aim of making it simple for every American to fill in and finish Form without pointless hassle or confusion. Watching the video guide listed below will help you work through each stage in the procedure.

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Keywords relevant to RI DoT RI-1041

- 14D

- 16b

- 16a

- nonresident

- 15a

- 14a

- 15C

- 14b

- 15b

- 15D

- 14C

- rhodeisland

- ridivision

- taxdue

- totalamountdue

USLegal fulfills industry-leading security and compliance standards.

-

VeriSign secured

#1 Internet-trusted security seal. Ensures that a website is free of malware attacks.

-

Accredited Business

Guarantees that a business meets BBB accreditation standards in the US and Canada.

-

TopTen Reviews

Highest customer reviews on one of the most highly-trusted product review platforms.