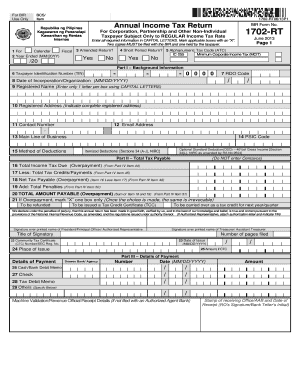

Get Ph Bir Form 1702-rt 2013-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the PH BIR Form 1702-RT online

Filling out the PH BIR Form 1702-RT online can simplify the process of submitting your annual income tax return for corporations, partnerships, and other non-individual taxpayers. This guide provides a step-by-step approach to ensure a smooth and accurate completion of this form.

Follow the steps to successfully complete the PH BIR Form 1702-RT online.

- Click the ‘Get Form’ button to initiate the process. This will allow you to download and access the form within an online editing environment.

- Fill in the background information section, which includes fields such as the taxpayer identification number (TIN), registered name, and date of incorporation. Ensure all entries are in capital letters as specified.

- Indicate the relevant period for which the tax return applies, specifying whether it is a calendar or fiscal year and whether it is an amended return or short period return.

- Complete the 'Method of Deductions' section by selecting the appropriate method, either itemized deductions or optional standard deduction, based on your accounting practices.

- In Part II, calculate the total tax payable. Input total income tax due, tax credits, and any penalties to determine the net tax payable.

- Review Part IV for calculations regarding taxable income. Include gross income, deductions, and calculate the income tax rate applicable.

- Detail your payment information in Part III, providing information about the method of payment and the amount.

- In the final sections, ensure all signatures are collected as needed, including those of the president or principal officer and the treasurer.

- Once you have completed all sections, save your changes. You can choose to download, print, or share the completed form as necessary.

Complete your PH BIR Form 1702-RT online today to ensure timely and accurate submission of your tax return.

Related links form

BIR Form 1701 is designed for self-employed individuals and businesses, while BIR Form 1702-RT is specifically for corporations and partnerships. The PH BIR Form 1702-RT includes provisions for corporate income tax and is generally more complex due to the nature of corporate financial statements. Understanding these differences is crucial for selecting the correct form based on your business structure.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.