Loading

Get Worksheet L Shared Responsibility Payment

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Worksheet L Shared Responsibility Payment online

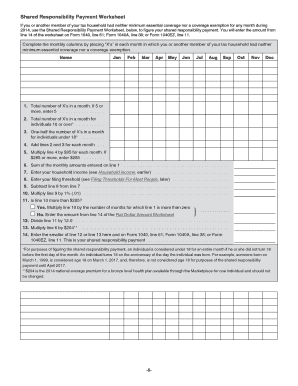

Filling out the Worksheet L Shared Responsibility Payment is an essential step for determining your shared responsibility payment if you or members of your tax household lacked required health coverage. This guide offers clear, step-by-step instructions to help you complete the worksheet accurately online.

Follow the steps to complete your worksheet efficiently.

- Click ‘Get Form’ button to access the worksheet and open it in your preferred online editor.

- Begin with the monthly columns by marking 'X' in each month where you or another member of your tax household did not have minimum essential coverage or a coverage exemption.

- Count the total 'X's for each month and record that number in line 1. If you have 5 or more, enter '5'.

- For individuals aged 18 or over, calculate the total number of 'X's for each of those months and enter it in line 2.

- Calculate one-half of the number of 'X's for any individuals under 18 for each month and record that total on line 3.

- Add the totals from lines 2 and 3 for each month and enter the results on line 4.

- Multiply the total from line 4 by $95 for each month to establish the figure for line 5. If your total is $285 or more, enter '285'.

- Sum the totals recorded on line 5 and enter that amount on line 6.

- Input your household income in line 7, as referenced in the household income guidelines.

- Enter your filing threshold in line 8, following the guidance provided earlier in the instructions.

- Subtract the amount on line 8 from line 7 and record the result on line 9.

- Multiply the amount from line 9 by 1% (.01) and write that figure on line 10.

- Determine if the amount on line 10 exceeds $285. If it does, multiply line 10 by the number of months marked on line 1.

- If line 10 is not greater than $285, enter the amount from line 14 of the Flat Dollar Amount Worksheet.

- Divide the amount calculated in line 11 by 12.0 and enter that total on line 12.

- Multiply the number in line 6 by $204 and document the result on line 13.

- Finally, enter the smaller amount between line 12 and line 13 on line 14, and ensure this amount is also recorded on Form 1040, line 61; Form 1040A, line 38; or Form 1040EZ, line 11. This is your shared responsibility payment.

Complete your Worksheet L Shared Responsibility Payment online today to fulfill your requirements efficiently.

The law prohibits the IRS from using liens or levies to collect any individual shared responsibility payment. However, if you owe a shared responsibility payment, the IRS may offset that liability against any tax refund that may be due to you.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.