Loading

Get Tiaa-cref 403b 401k Salary Reduction Agreement Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the TIAA-CREF 403b 401k Salary Reduction Agreement Form online

This guide provides clear, step-by-step instructions for filling out the TIAA-CREF 403b 401k Salary Reduction Agreement Form online. Whether you are new to this process or looking to refresh your knowledge, this comprehensive guide will support you in completing each section accurately.

Follow the steps to successfully complete the form.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

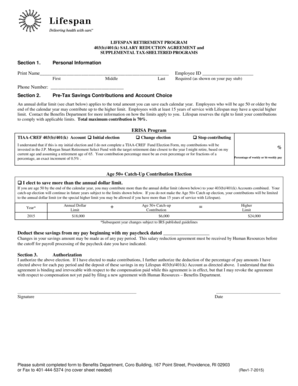

- In Section 1, enter your personal information. Provide your full name, including first, middle, and last names, as well as your employee ID as shown on your pay stub. Don’t forget to include your phone number for contact purposes.

- In Section 2, review the annual dollar limit for pre-tax savings contributions. Decide whether this is your initial election, a change of election, or if you wish to stop contributing. If this is your first election, remember that your contributions will be automatically invested unless you select an alternative fund.

- Indicate your contribution percentage in the provided field. Ensure that the percentage is even, or if in fractional percentages, it must be an exact increment of 0.5%.

- If applicable, check the box for Age 50+ Catch-Up Contribution Election if you are eligible to contribute beyond the annual dollar limit. Make sure to understand how these limits apply to your situation.

- Specify the date when you want your savings deductions to begin. Keep in mind that any changes in your savings amounts can be made at any pay period, but the form must be submitted to Human Resources before the payroll cutoff.

- In Section 3, review the authorization statement. Sign and date the form to confirm your elections and understanding of the agreement. This signature indicates that you authorize the payroll deductions as indicated.

- Finally, submit your completed form to the Benefits Department via the designated address or fax number. Ensure you keep a copy for your records.

Complete your documents securely online to ensure a smooth process.

A salary reduction contribution plan allows employees to reduce their taxable income by investing for retirement. So an employee's salary isn't really reduced; rather the employer deducts a percentage of their salary and deposits the funds in a retirement savings plan so the money can grow tax deferred.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.