Loading

Get Mha Dodd-frank Certification 2010-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MHA Dodd-Frank Certification online

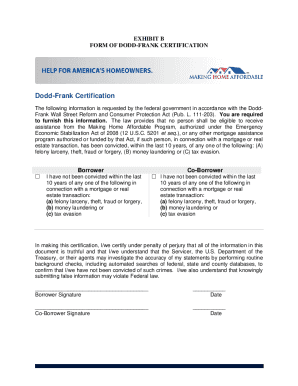

The MHA Dodd-Frank Certification is a crucial document in ensuring compliance with the Dodd-Frank Act for participants of the Making Home Affordable program. This guide provides clear, step-by-step instructions for filling out the certification online, enabling users to navigate the process with confidence.

Follow the steps to complete the MHA Dodd-Frank Certification online.

- Press the ‘Get Form’ button to access the certification form and open it in an editable format.

- Begin filling out the form by entering your information in the designated fields. This includes your name, address, and any co-borrower's details if applicable.

- Review the certification statement and ensure you understand the requirements outlined regarding convictions related to felony larceny, theft, fraud, forgery, money laundering, or tax evasion.

- Tick the appropriate box for the borrower and co-borrower to certify that neither has been convicted of events mentioned in the certification statement within the past ten years.

- Sign and date the form in the designated signature fields, ensuring that both the borrower and co-borrower provide their signatures if applicable.

- After completing the form, you can save the changes made. Options to download, print, or share the filled-out certification are available, ensuring you have a copy for your records.

Get started and complete your MHA Dodd-Frank Certification online today!

MHA stands for the Mortgage Bankers Association's professional certification program. It is designed for professionals in the mortgage industry to demonstrate their knowledge and expertise. The MHA Dodd-Frank Certification specifically focuses on the Dodd-Frank Act, equipping you with critical insights into compliance and regulatory requirements.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.