Loading

Get Non Profit Organization Npo Information Return

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Non Profit Organization NPO Information Return online

Filling out the Non Profit Organization NPO Information Return is an essential process for eligible organizations to report their financial information. This guide provides a clear, step-by-step approach to completing the form online, ensuring accuracy and compliance.

Follow the steps to successfully complete your NPO Information Return online.

- Click 'Get Form' button to obtain the form and open it in the editor.

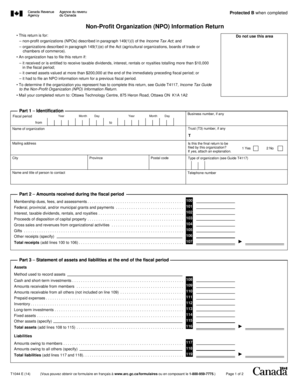

- Begin with Part 1 - Identification. Fill in the fiscal period details including the start and end dates. Provide your organization's name, business number, mailing address, and contact person's name and title. Indicate whether this is the final return for the organization.

- Move to Part 2 - Amounts received during the fiscal period. Accurately report all sources of income including membership dues, grants, interest, rentals, and total receipts. Be sure to total the amounts received.

- Proceed to Part 3 - Statement of assets and liabilities. List all assets such as cash, receivables, and prepaid expenses. Then, record the liabilities including amounts owed to members and others. Calculate the totals for both assets and liabilities.

- In Part 4 - Remuneration, enter total remuneration paid to employees and officers, along with any other relevant payments. Also, indicate the number of members in the organization.

- Complete Part 5 - The organization's activities. Briefly describe the organization's activities and mention if any activities were conducted outside of Canada.

- If applicable, provide information in Part 6 - Location of books and records. If this information is the same as Part 1, you may leave it blank.

- Finally, in Part 7 - Certification, an authorized officer must certify the completeness and accuracy of the information provided in the return. Include their name, position, signature, and date.

- After filling out the form, save your changes. You can then download, print, or share the completed form as needed.

Take action today by completing your Non Profit Organization NPO Information Return online.

Most tax-exempt organizations are required to file annual tax returns with the IRS. Even though most tax-exempt nonprofit organizations do not pay federal taxes on revenue related to their purpose, most do have to file an informational return with the IRS. This annual reporting return is called a Form 990.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.