Get Sc Ib 303 2005-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the SC IB 303 online

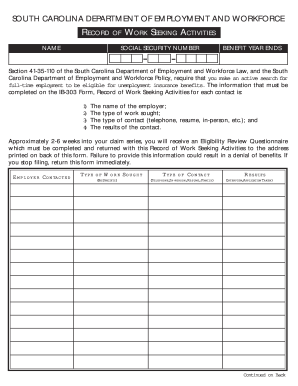

The SC IB 303 form, also known as the Record of Work Seeking Activities, is essential for individuals seeking unemployment insurance benefits in South Carolina. Completing this form accurately is vital for maintaining eligibility and ensuring timely processing of your benefits.

Follow the steps to fill out the form correctly.

- Click the ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your Social Security number in the designated field to verify your identity.

- Next, indicate your benefit year end date to provide context for your job search activities.

- In the first section, list the name of the employer you contacted in the current row.

- In the next field, specify the type of work you are seeking, providing a clear and detailed description.

- Then, note the type of contact you made, such as whether it was via telephone, in-person meeting, or by sending a resume.

- Finally, document the results of the contact, whether you had an interview, submitted an application, or received any other response.

- Repeat steps 4 to 7 for each additional employer contact, as necessary, ensuring you have captured all relevant activities.

- Once you have completed the form, review all entries for accuracy and clarity. You can then save your changes, download, or print the form for submission.

Start completing your SC IB 303 form online today!

Penn State hosts a robust international business program, which prepares students for global careers. Their curriculum incorporates essential elements of SC IB 303, equipping students with the skills needed for international markets. Students benefit from networking opportunities and real-world applications through internships and global business projects. Explore Penn State’s offerings to see how they fit your academic and career goals.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.