Loading

Get Form No Mgt-7 Annual Return - Btaxguruinb

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the FORM NO MGT-7 Annual Return - BTaxguruInb online

This guide provides a comprehensive, user-friendly approach to filling out the FORM NO MGT-7 Annual Return - BTaxguruInb online. Users with varying levels of legal experience will find clear instructions to navigate each section of the form effectively.

Follow the steps to complete your annual return accurately.

- Press the ‘Get Form’ button to obtain the form and access it for completion.

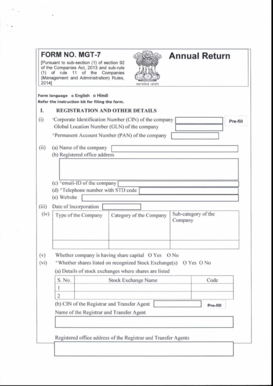

- Begin with the registration and other details section. Enter the Corporate Identification Number (CIN), Global Location Number (GLN), and Permanent Account Number (PAN) of the company. Additionally, provide the company name, registered office address, email ID, telephone number with STD code, and website URL.

- Indicate the date of incorporation and specify the type of company along with its category and sub-category. Confirm if the company has share capital and whether shares are listed on recognized stock exchanges.

- In the principal business activities section, provide the number of business activities and describe each activity along with its activity code.

- Detail the particulars of holding, subsidiary, and associate companies, as well as joint ventures. List the companies accordingly.

- Fill out the share capital, debentures, and other securities section. Provide information on the authorized, issued, subscribed, and paid-up capital for equity and preference shares, including their classes and nominal values.

- Enter the turnover and net worth of the company as defined in the Companies Act, 2013.

- Complete the shareholding pattern for promoters and public shareholders. Record the number of shares held by each category of shareholders.

- Fill the director's details and board meetings information, including attendance records for each meeting held throughout the financial year.

- Provide details on the remuneration of directors and key managerial personnel, ensuring all necessary information is included.

- Confirm compliance with the provisions of the Companies Act where applicable. If there have been any penalties or disciplinary actions, document those appropriately.

- Review all sections for accuracy and completeness. Save changes and proceed to download, print, or share the completed form.

Start filling out your FORM NO MGT-7 Annual Return online to ensure timely compliance.

Annual return in form MGT-7A by Every small company and the OPC shall prepare with particulars of the financial year related wherever applicable: Its principal business activities, registered office, particulars of its associate companies.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.