Loading

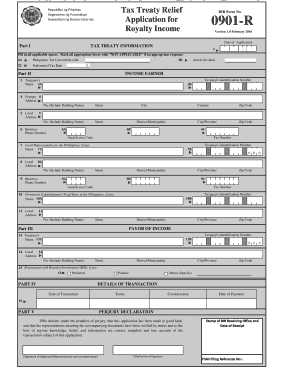

Get Bir Form No 0901- R - Ftp Bir Gov

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the BIR Form No 0901- R - Ftp Bir Gov online

Filling out the BIR Form No 0901-R is essential for applying for tax treaty relief specific to royalty income. This guide offers clear, step-by-step instructions to help you navigate the form online successfully.

Follow the steps to complete the BIR Form No 0901-R online.

- Click the ‘Get Form’ button to access the form and open it in the editor.

- Begin by filling out Part I, titled 'Tax treaty information.' Fill in all applicable spaces and mark 'NOT APPLICABLE' in the appropriate boxes where needed. Specify the Philippines Tax Convention and the relevant article invoked, along with the preferential tax rate that applies.

- Proceed to Part II to enter your Taxpayer's Identification Number and the income earner's name. Ensure to fill in the foreign address, including details such as street name, city, country, and zip code.

- Complete the local address section by providing your local phone number and any additional local representative information if applicable. Include their name, local address, and phone details.

- Move to Part III where you will detail the payor of income. Again, provide information including name, local address, and Taxpayer's Identification Number, mirroring the structure from Part II.

- In Part IV, complete the details of the transaction. This includes specifying the date of the transaction, terms, considerations, and payment dates.

- In Part V, you need to declare the application under penalties of perjury. Ensure you have the signature of the applicant or representative, along with their title and any required stamps.

- Finally, review Part VI for documentary requirements. Gather all necessary documents, including proof of residency, articles of incorporation, and any specific documentation regarding the royalty income.

- Once all sections are accurately filled, save your changes. You can then download, print, or share the completed form as necessary.

Complete your BIR Form No 0901-R online efficiently today.

Step 1: Go to the income tax India website at .incometax.gov.in and log in. Step 2: Select the 'e-File'>'Income Tax Returns'>'View Filed Returns' option to see e-filed tax returns. Step 3: To download ITR-V click on the 'Download Form' button of the relevant assessment year.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.