Loading

Get Ie Form P60 Laser

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IE Form P60 Laser online

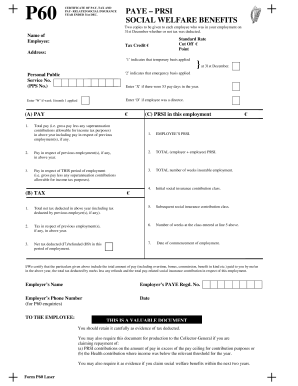

Filling out the IE Form P60 Laser online is an important task for employers to ensure accurate documentation of employee earnings, tax deductions, and social insurance contributions. This guide will provide a detailed, step-by-step approach to completing the form, making the process clear and manageable for all users.

Follow the steps to complete the IE Form P60 Laser online.

- Click 'Get Form' button to access the IE Form P60 Laser and open it in your chosen document editor.

- In the 'Name of Employee' field, enter the full name of the employee for whom the P60 is being prepared.

- Fill in the 'Personal Public Service No. (PPS No.)' with the unique identifier for the employee.

- Complete the sections indicating tax credit, standard rate cut-off points, and any applicable temporary or emergency pay basis for the employee.

- Under the 'PAY' section, input the total gross pay for the year, including previous employment earnings, while excluding any superannuation contributions.

- In the 'TAX' section, enter the total net tax deducted over the year, including any amounts from previous employers, along with the details of the tax refunds during this period of employment.

- Review the completion and ensure all the details are accurate. Once satisfied, save your changes.

- Finally, download, print, or share the completed P60 form as necessary for your records and to provide to the employee.

Complete your IE Form P60 Laser online today to maintain accurate employee records.

The P60 generally does not include dividends, as it focuses on employment earnings and the corresponding tax deductions. If you receive dividends from investments, these are reported separately, often on a different form. It's essential to keep records of all your income sources, including dividends, to ensure you file your taxes correctly.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.