Loading

Get Ssa-7050-f4 2014

This website is not affiliated with any governmental entity

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the SSA-7050-F4 online

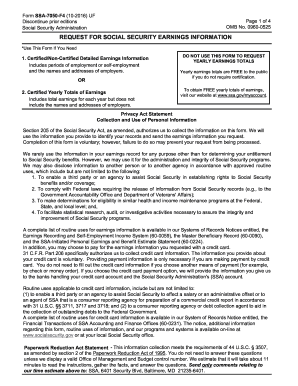

Filling out the SSA-7050-F4 online can help you request important Social Security earnings information efficiently. This guide provides step-by-step instructions to ensure you correctly complete the form and understand its components.

Follow the steps to fill out the SSA-7050-F4 form online.

- Use the 'Get Form' button to access the SSA-7050-F4 form and open it in the designated editor.

- Begin by entering your name exactly as it appears on your most recent Social Security card, followed by your Social Security Number (SSN) and Date of Birth in the specified fields.

- Indicate what kind of earnings information you need by selecting one of the options: either an itemized statement of earnings or certified yearly totals. Make sure to check the corresponding box.

- If you require an itemized statement, include the reasons and the specific years for which you are requesting earnings information in the provided sections.

- Choose whether you would like the information to be sent to someone else by completing section 3 with their name and address.

- In section 4, confirm the relationship to the individual whose earnings you're requesting, if applicable, and provide your signature and printed name. Include the date and a daytime phone number.

- If you are signing with a mark (X), ensure that two witnesses also provide their signatures and addresses in the designated area.

- Prepare your payment based on the type of earnings statement requested, writing the check or money order to the Social Security Administration if applicable.

- Mail your completed form, any required supporting documents, and payment to the correct address provided on the form. Allow 120 days for processing.

- You may choose to save changes, download, and print the form, or share via email as necessary.

Complete your request for Social Security earnings information online now.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

They have a limited amount of time in which to do so: three years, three months, and 15 days following the end of the calendar year in which they earn the income.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.