Get Il Co-1 2019

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IL CO-1 online

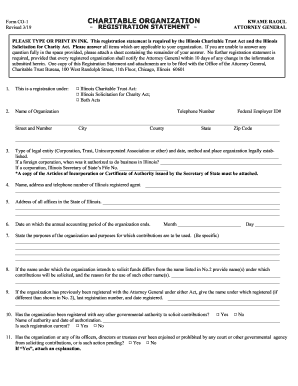

The IL CO-1 form is a registration statement required by the Illinois Charitable Trust Act and the Illinois Solicitation for Charity Act. This guide aims to assist users in understanding and accurately completing this form online, ensuring compliance with legal requirements.

Follow the steps to fill out the IL CO-1 form online with ease.

- Press the ‘Get Form’ button to access the IL CO-1 form and open it in your preferred editor.

- Begin by identifying which registration applies to your organization: Illinois Charitable Trust Act, Illinois Solicitation for Charity Act, or both. Check the corresponding box.

- Enter the name of your organization in the appropriate field along with the telephone number and Federal Employer ID number.

- Provide details about the type of legal entity (e.g., Corporation, Trust, Unincorporated Association) along with the date, method, and place of establishment.

- If applicable, include the authorization date for foreign corporations to operate in Illinois and the Illinois Secretary of State's File Number.

- List the name, address, and phone number of your Illinois registered agent.

- Fill in the address of all offices located in Illinois.

- Indicate the ending date of your organization’s annual accounting period.

- Clearly state the purposes of your organization and how contributions will be utilized.

- If your organization will solicit funds under a different name, provide that name and explain the reason for its use.

- Supply information regarding any previous registrations with the Attorney General under either Act, including the name and registration number.

- Answer the question regarding registration with any other governmental authority and provide details if applicable.

- Disclose whether any officers or directors have been involved in legal issues related to solicitation.

- If intending to use a professional fund raiser, furnish their name and address and confirm if they have registered.

- List the board or individuals responsible for deciding how contributions are used.

- Specify the methods of solicitation your organization intends to use.

- Provide the name, mailing address, and title of your chief executive or staff officer.

- Attach a list of all officers, directors, and trustees with their contact details.

- Indicate if the organization has received tax-exempt status and attach relevant documents.

- Confirm if your tax-exempt status has faced any challenges.

- Attach required documents based on your legal entity type.

- Once all sections are completed, save changes, download, or print the form as needed, ensuring you obtain signatures from required officers.

Start your registration process by completing the IL CO-1 form online today.

Get form

The Illinois Charitable Trust Act applies to all organizations that operate as charities, including charitable foundations and non-profit organizations. It governs how these entities manage and distribute their funds. Compliance with the act is crucial for maintaining tax-exempt status and operational legitimacy. For guidance on adhering to the IL CO-1 requirements, the uslegalforms platform is a reliable resource.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.