Loading

Get 3232 Tax Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 3232 Tax Form online

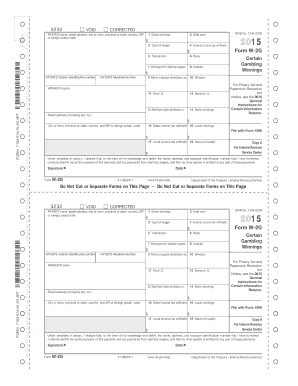

The 3232 Tax Form is essential for reporting gambling winnings and associated taxes. This guide provides step-by-step instructions to help users fill out the form accurately and efficiently online.

Follow the steps to complete your 3232 Tax Form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Fill in the gross winnings (Line 1) that you received. This should reflect the total amount won.

- Enter the date won (Line 2) in the appropriate format, which is usually MM/DD/YYYY.

- Specify the type of wager (Line 3) to give context for the winnings. This could include details such as sportsbook betting, lottery, etc.

- Indicate the federal income tax withheld (Line 4), ensuring you input the total amount withheld from your winnings.

- Complete the transaction details (Line 5) that further describe how the winnings were obtained.

- If applicable, report winnings from identical wagers (Line 7) by providing the necessary details.

- Document the cashier’s information (Line 8), including their contact details.

- Fill in the winner’s taxpayer identification number (Line 9) for identification purposes.

- Input the winner’s name (Line 10) as it appears on official documents.

- Provide identification details (Line 11 & Line 12) to further validate your identity.

- Enter the state or payer’s state identification number (Line 13) where applicable.

- Complete the state winnings (Line 14) if any were earned, including the monetary amount.

- Detail any state income tax withheld (Line 15) as part of the filings.

- If local winnings were earned (Line 16), indicate the amount along with any local income tax withheld (Line 17).

- Provide the name of the locality (Line 18) where the winnings were obtained.

- Finally, sign and date the form to affirm the accuracy of the information provided. Ensure you are aware of the penalties of perjury assigned to this declaration.

- Once completed, save your changes, and then download, print, or share the form as required.

Start filling out your documents online today.

Related links form

This fine is charged to those who do not file a tax return by the annual due date, which is typically April 15 of the following tax year. The cost of this civil penalty is 5 percent of your total tax bill for each month or partial month in which you failed to file your tax return, up to a maximum of 25 percent.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.