Get Self Employment Statement

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Self Employment Statement online

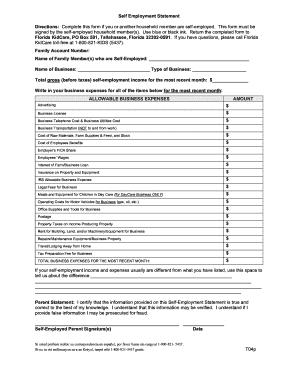

Completing the Self Employment Statement is essential for individuals who are self-employed and wish to accurately report their income and expenses. This guide provides clear instructions on how to fill out the form online, ensuring that all required information is captured properly.

Follow the steps to complete your Self Employment Statement online:

- Press the ‘Get Form’ button to access the Self Employment Statement and open it in your preferred online editing tool.

- Fill in your Family Account Number at the designated space on the form.

- Provide the name of the self-employed household member or members in the respective fields.

- Indicate the name of the business in the given section.

- Specify the type of business you are engaged in by selecting from the choices provided.

- Enter your total gross self-employment income for the most recent month before any taxes.

- List all allowable business expenses for the most recent month in the appropriate fields provided. Include expenses such as advertising, business license costs, utilities, transportation costs, employee wages, and other specified categories.

- Calculate and enter the total amount of business expenses for the most recent month.

- If your self-employment income or expenses differ from what is recorded, provide an explanation in the designated area.

- Review all the information entered to ensure accuracy.

- Sign the Parent Statement certifying that the information is true and correct and provide the date.

- Once satisfied with the completed form, use the options available to save changes, download, print, or share the Self Employment Statement.

Complete your Self Employment Statement online today to ensure your information is filed correctly.

To make receipts for self-employment, include essential information such as your business name, date of service, amount charged, and description of services provided. You can create receipts manually or use templates available on platforms like uslegalforms. This makes it easy to ensure your receipts are professionally formatted and ready for your Self Employment Statement. Regular receipt documentation helps keep your finances organized and transparent.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.