Loading

Get Form W8ben-e Substitutev3docx

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form W8BEN-E Substitute online

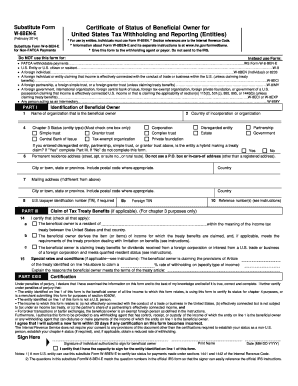

Filling out the Form W8BEN-E Substitute online is essential for non-U.S. entities to certify their foreign status for U.S. tax withholding purposes. This guide will provide clear steps and insights to assist you in accurately completing the form.

Follow the steps to fill out the Form W8BEN-E Substitute online.

- Click ‘Get Form’ button to obtain the form and open it in the online editor.

- Begin with Part I, where you will identify the beneficial owner. Enter the name of the organization as it appears in official documents.

- Provide the country where the organization is incorporated or organized. This will assist in identifying the entity's tax obligations.

- In this section, check one box to indicate the chapter 3 status of the entity. Options include corporation, partnership, tax-exempt organization, etc. Remember to select only one.

- Enter the permanent residence address. Make sure to provide a full street address, including city, state, and postal code; do not use P.O. boxes.

- If the mailing address differs from the permanent address, enter it in the corresponding section along with the relevant city, state, and postal code.

- Complete the U.S. taxpayer identification number section if required, along with any foreign taxpayer identification number applicable.

- Proceed to Part III to claim any tax treaty benefits. Indicate the country of residence for treaty claims and certify eligibility by checking the appropriate boxes.

- Provide any special conditions or rates being claimed under the tax treaty, including the article and percentage rate of withholding, if applicable.

- In Part XXIX, review the certification statements carefully. Ensure all information is accurate and finalize the form by signing and dating it. Ensure that the individual signing has the authority to do so for the organization.

- Once all sections are completed, users can save changes, download, print, or share the completed form as needed.

Complete your Form W8BEN-E Substitute online today to ensure compliance with U.S. tax regulations.

Generally, an amount subject to chapter 3 withholding is an amount from sources within the United States that is fixed or determinable annual or periodical (FDAP) income (including such an amount on a PTP distribution except as indicated otherwise).

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.