Loading

Get Form 9325

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 9325 online

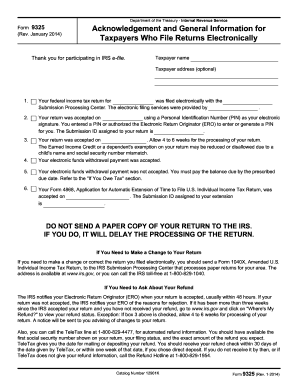

Form 9325, Acknowledgement and General Information for Taxpayers Who File Returns Electronically, provides important information for taxpayers who have filed their returns online. This guide will assist you in understanding how to complete this form accurately and efficiently.

Follow the steps to complete Form 9325 online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Complete the section for Taxpayer name by entering your full name as it appears on your tax return.

- If desired, fill in the Taxpayer address field. This is optional but can be helpful for identification purposes.

- Indicate the year for which your federal income tax return was filed electronically. This information is crucial for processing.

- Provide the name of the Submission Processing Center where your return was filed. This information is typically provided in your confirmation email.

- Input the date your return was accepted. This data is essential for keeping track of your submission.

- Enter your Personal Identification Number (PIN) that serves as your electronic signature. If you authorized an Electronic Return Originator (ERO) to generate a PIN on your behalf, make sure they have inputted this correctly.

- Document the Submission ID assigned to your return. This ID is vital for tracking your submission in the IRS system.

- If applicable, note whether your electronic funds withdrawal payment was accepted or not. If it was not accepted, refer to the relevant instructions on making payments.

- Review all the information provided for accuracy before proceeding to save changes, download, print, or share the completed form.

Complete your Form 9325 online for a smooth filing process.

The address is available at .irs.gov, or you can call the IRS toll-free at 1-800-829-1040. The IRS notifies your Electronic Return Originator (ERO) when your return is accepted, usually within 48 hours. If your return was not accepted, the IRS notifies your ERO of the reasons for rejection.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.