Get Advanced Benefit Strategies Abs Sec 125 Hcr Dcr Health

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Advanced Benefit Strategies ABS Sec 125 HCR DCR Health online

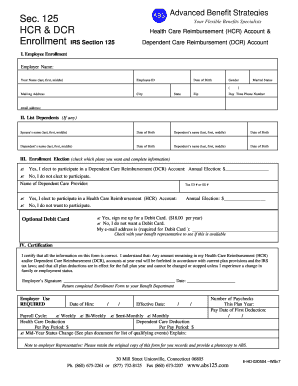

Filling out the Advanced Benefit Strategies ABS Sec 125 HCR DCR Health form is a vital step for users looking to manage their flexible benefits. This guide offers clear, step-by-step instructions to ensure you complete the form accurately and efficiently.

Follow the steps to successfully complete your enrollment

- Click ‘Get Form’ button to acquire the form and open it in your preferred online editing tool.

- Begin by entering your employer's name in the designated field. This identifies your workplace for the form.

- Next, fill in your name, ensuring you include your last name, first name, and middle initial.

- Provide your employee ID to verify your employment status.

- Enter your date of birth in the specified format, ensuring accuracy as this is essential for your enrollment.

- Indicate your gender by selecting the appropriate option from the choices provided.

- Complete your mailing address, including city, state, and zip code, to ensure proper correspondence.

- If applicable, enter your spouse's name and their date of birth in the specified fields.

- List any dependents by providing their names and dates of birth. Include as many dependents as necessary.

- Check the box to elect participation in the Dependent Care Reimbursement (DCR) Account if desired, and fill in the annual election amount.

- Name the dependent care provider along with their Tax ID or Social Security number.

- Check the box to elect participation in the Health Care Reimbursement (HCR) Account if desired, and fill in the annual election amount.

- Indicate whether you want an optional debit card, specifying your email address if you select this option.

- Read through the certification section carefully before signing. Ensure all information is correct, sign your name, and provide the date.

- Once completed, return the form to your Benefit Department as instructed.

Complete your enrollment successfully by filling out the Advanced Benefit Strategies ABS Sec 125 HCR DCR Health form online today.

The difference is that members do not keep their unused FSA money and funds may be forfeited back your employer. FSAs are generally paired with traditional health plans. An HRA is an employer-owned and -employer-funded account designed to help members bridge the gap on eligible healthcare expenses.

Fill Advanced Benefit Strategies ABS Sec 125 HCR DCR Health

A Health Care Flexible Spending Account is a fringe benefit plan, which is authorized under the IRS code Section 125. Health Care Reimbursement Accounts. Since 1993, Advanced Benefit Strategies has been the industry leader in Flexible Spending Account administration and Section 125, FSA Cafeteria Plans. Advanced Benefit Strategies. ABS. Your Flexible Benefits Specialists. ABS Advanced Benefit Strategies. Your Flexible Benefit Specialistss. Sec. A flexible spending plan is only offered through payroll deduction.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.