Loading

Get Vat652

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Vat652 online

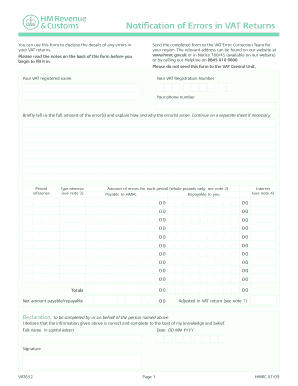

Understanding how to properly fill out the Vat652 form is essential for disclosing errors in your VAT returns. This guide provides a clear and supportive approach to help you complete the form accurately.

Follow the steps to fill out the Vat652 form with ease.

- Click the ‘Get Form’ button to obtain the Vat652 form and open it in your preferred format for editing.

- Begin by entering your VAT registered name in the designated field. This should match the name associated with your VAT registration.

- Provide your VAT Registration Number in the relevant field. This is crucial for identifying your account with HMRC.

- Fill in your contact phone number. Ensure this is a number where you can be easily reached for any follow-up questions.

- Briefly describe the full amount of the error(s) you are reporting. Include a clear explanation of how and why these error(s) occurred. If necessary, continue your explanation on a separate sheet.

- Indicate the ‘Period reference’ for which the errors pertain. This is the VAT accounting period during which the error occurred.

- In the ‘Type reference’ box, specify the type of errors you are reporting by entering ‘0’ for output tax errors and ‘1’ for input tax errors.

- For each accounting period listed, enter the amount of errors. Rounding is required: amounts payable to HMRC should be rounded down to the nearest pound, while amounts payable to you should be rounded up.

- Complete the section labeled ‘Interest’ if applicable. Mark ‘Yes’ if interest is to be charged, or ‘No’ if you believe it does not represent commercial restitution.

- Indicate whether this adjustment has been included in your VAT return by marking ‘Yes’ or ‘No’ in the corresponding box.

- In the declaration section, the individual completing the form should print their full name in capital letters, provide the date of completion, and sign to confirm the information is correct.

- Once you have completed the form, save changes. You may also download, print, or share the form as needed.

Complete your VAT error corrections online today for a smoother process.

You usually need to send a VAT Return to HMRC every 3 months. This is known as your 'accounting period'. If you're registered for VAT , you must submit a VAT Return even if you have no VAT to pay or reclaim. This guide is also available in Welsh (Cymraeg).

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.