Loading

Get Utah State Tax Return 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Utah State Tax Return online

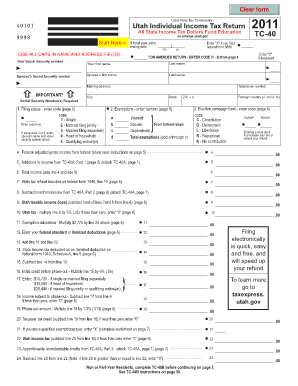

Filing your Utah State Tax Return online can simplify the process and ensure accuracy. This guide provides clear instructions on how to complete the form in a user-friendly manner, tailored for individuals with varying levels of experience.

Follow the steps to successfully complete your online Utah State Tax Return.

- Click 'Get Form' button to access the Utah State Tax Return form. This action will allow you to open the document in your preferred format.

- Enter your personal information, including your name, address, and Social Security number in the designated fields. Ensure that you use all capital letters when filling out the name and address sections.

- Select your filing status by entering the corresponding code from the list provided. The available options include Single, Married Filing Jointly, Married Filing Separately, Head of Household, and Qualifying Widow(er).

- Indicate the number of exemptions you are claiming. This includes yourself, your spouse, and any dependents.

- Report your federal adjusted gross income as listed on your federal return. Follow the prompts to accurately input this information.

- Add any additions to income from TC-40A, if applicable, and total this to determine your overall income.

- Complete the subtractions from your income, also using TC-40A, to accurately determine your taxable income.

- Calculate the Utah tax by multiplying your taxable income by the specified tax rate. If this value is negative, enter '0'.

- Fill out any applicable credits and deductions, including any election campaign fund contributions and previous credits that may apply to your current filing.

- Review your entries thoroughly for accuracy. Once completed, you can save changes, download, print, or share the form securely.

Start filing your Utah State Tax Return online today for a streamlined process and quicker refunds.

Utah state tax forms are readily available on the Utah State Tax Commission website. You can also visit local tax offices, libraries, or public resource centers to find printed forms. Accessing these forms is important for completing your Utah State Tax Return efficiently.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.