Loading

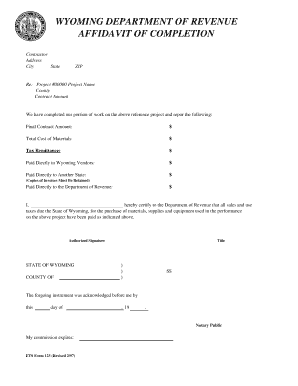

Get Wyoming Department Of Revenue Affidavit Of Completion

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the WYOMING DEPARTMENT OF REVENUE AFFIDAVIT OF COMPLETION online

Filling out the Wyoming Department of Revenue Affidavit of Completion online is a straightforward process. This guide will provide step-by-step instructions to help you accurately complete the affidavit, ensuring you meet all requirements for your project.

Follow the steps to complete the affidavit with ease.

- Click 'Get Form' button to access the affidavit and open it in your editor.

- Enter your information in the 'Contractor' section, including your name and address. Fill in the city, state, and ZIP code accurately to ensure proper identification.

- In the 'Project #' field, input your project number followed by the 'Project Name'. Provide the county where the project is located for record-keeping purposes.

- Indicate the total contract amount for the project in the designated field. This figure should reflect the complete financial agreement for the work completed.

- Provide detailed cost information in the subsequent fields: enter the 'Total Cost of Materials', 'Tax Remittance', 'Paid Directly to Wyoming Vendors', 'Paid Directly to Another State', and 'Paid Directly to the Department of Revenue'. Ensure that all amounts are accurate and documented.

- Attach copies of invoices as instructed, ensuring they are retained for verification purposes.

- In the certification section, print your name in the space provided, sign the affidavit to confirm accuracy, and state your title.

- Where indicated, fill in the state and county for the notary public. This step is crucial for authentication.

- Complete the notary section by having your signature acknowledged, noting the date, and entering the notary public commission expiration date.

- After completing the form, review all entered information carefully. Save your changes, download the document, print a copy for your records, or share the form as required.

Begin the process of filing your affidavit online today to ensure compliance and proper documentation.

How do you register for a sales tax permit in Wyoming? You can apply online at the Wyoming Internet Filing System for Business. You can also apply on paper and mail or fax in the Wyoming Sales/Use Tax Application. You can call (307) 777-5200 for assistance completing the application.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.