Get Mha Dodd-frank Certification 2010-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MHA Dodd-Frank Certification online

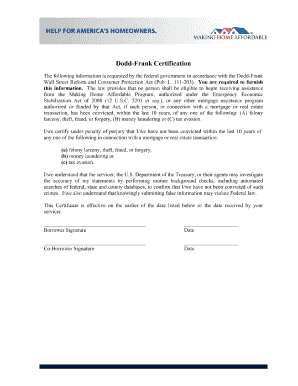

The MHA Dodd-Frank Certification is an essential document required to participate in mortgage assistance programs under the Dodd-Frank Wall Street Reform and Consumer Protection Act. This guide will provide you with clear, step-by-step instructions on how to complete the certification form online.

Follow the steps to complete your MHA Dodd-Frank Certification effectively.

- Click 'Get Form' button to access the MHA Dodd-Frank Certification. This action will allow you to download the document and open it in your preferred editor.

- Read the introductory section carefully. It outlines the legal requirements and the potential consequences of providing false information. Ensure you fully understand the implications of this certification.

- In the provided fields, enter your full name and any co-borrower's name, if applicable. Ensure that you use the correct spelling as it appears on official documents.

- Review the statements regarding convictions. You will need to certify that neither you nor your co-borrower has been convicted of any specified crimes related to mortgage or real estate transactions within the last ten years.

- Sign the certification by entering your signature in the designated field. Ensure that your signature matches the one on your official documents.

- Date the document by entering the appropriate date beside your signature. This date will mark the effective date of the certification.

- If applicable, repeat steps 3 to 6 for each co-borrower involved in the transaction.

Complete your MHA Dodd-Frank Certification online today to ensure your eligibility for mortgage assistance programs.

A clear example of a violation of the Dodd-Frank Act includes practices like deceptive lending or failing to disclose critical information to consumers. Such actions undermine the goals of the Act, which emphasize transparency and consumer protection. Regulators can impose penalties or sanctions in cases of violation. Staying up-to-date with compliance standards, including MHA Dodd-Frank Certification, can help avoid these violations.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.