Loading

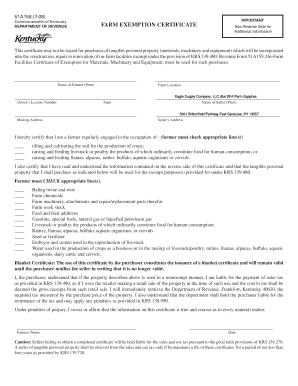

Get 51a158 7-08 Farm Exemption Certificate

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 51A158 7-08 FARM EXEMPTION CERTIFICATE online

Filling out the 51A158 7-08 Farm Exemption Certificate online is a crucial step for farmers looking to claim tax exemptions on specific farm-related purchases. This guide provides a detailed, step-by-step approach to help you accurately complete this essential document.

Follow the steps to complete your farm exemption certificate online.

- Click the ‘Get Form’ button to obtain the form and open it in your preferred online editing tool.

- Begin by entering the name of the farmer. This should be printed clearly in the designated field.

- Provide the farm location, specifying the county and any other relevant details.

- Input the driver's license number in the appropriate section to verify the identity of the farmer.

- Fill in the seller's name and their address, ensuring all details are accurate.

- Indicate the appropriate lines to certify that you are engaged in farming activities, checking all relevant areas.

- Select from the provided list of items that you wish to purchase exempt from sales tax, checking all applicable options.

- Acknowledge the blanket certificate section by understanding its implications on future purchases.

- Affirm the truthfulness of your statements by printing your name and signing in the designated space.

- Date the certificate appropriately, ensuring it reflects the current date of completion.

- Once all sections are filled out, review the certificate for any errors, then save your changes, download a copy, and print for sharing.

Complete your documents online today to enjoy the benefits swiftly.

SALES AND USE TAX CERTIFICATE OF EXEMPTION In order to be deemed a “farmer,” a person must be engaged in the business of producing agricultural products for market. Va. Code § 58.1-609.2(1) provides that the Virginia retail sales and use tax shall not apply to (check appropriate box):

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.