Loading

Get Sample Filled Up Bir Form 2307 Excel

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Sample Filled Up Bir Form 2307 Excel online

This guide provides expert instructions on completing the Sample Filled Up Bir Form 2307 Excel online. By following these steps, users can ensure their forms are accurately filled out and ready for submission.

Follow the steps to effectively complete your form.

- Click the 'Get Form' button to obtain the form and open it in your preferred online editing tool.

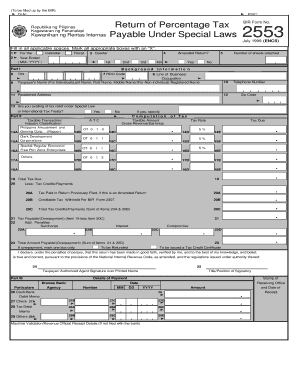

- Begin filling out the basic information in the header section, including the Document Locator Number (DLN) and the Philippine Standard Industry Classification (PSIC).

- Indicate if the return is for a calendar year or fiscal year by marking the appropriate box.

- Select the applicable quarter for the year ended and ensure the year is in the correct format (MM/YYYY).

- Complete Part I by filling in the Tax Identification Number (TIN), checking if the return is amended, and noting the number of sheets attached.

- Provide the Revenue District Office (RDO) code, line of business or occupation, and the taxpayer's name (use 'Last Name, First Name, Middle Name' for individuals and 'Registered Name' for non-individual entities).

- Fill in the registered address, telephone number, and zip code as required.

- Indicate if availing of tax relief under special law or international tax treaty by marking 'Yes' or 'No'. If 'Yes', specify it in the provided space.

- Proceed to Part II to classify your taxable transaction or industry, providing gross revenue and tax details as outlined in the sections.

- In the computation section, enter the taxable amount, tax rate, and calculate the tax due for each category.

- Summarize the total tax due, and mention any tax credits or payments that may be applicable.

- Calculate the total amount payable or overpayment and indicate if you prefer a refund or tax credit certificate if applicable.

- Complete the declaration section by signing over the printed name and including the title or position of the signatory.

- Review your filled form for accuracy before saving changes. Finally, choose to download, print, or share the form as needed.

Complete your documents online now to ensure compliance and accuracy.

Calculating EWT for a 2307 form in the Philippines requires you to first detect the applicable tax rates for your transactions. Use the formula provided in the Sample Filled Up Bir Form 2307 Excel as a template. Accurately input the necessary transaction details to compute the EWT easily. This method enhances your compliance and ensures proper tax reporting.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.