Loading

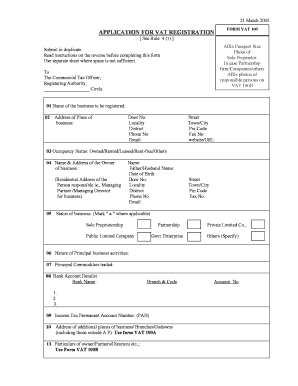

Get Application For Vat Registration Form Vat 100

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the APPLICATION FOR VAT REGISTRATION FORM VAT 100 online

Completing the APPLICATION FOR VAT REGISTRATION FORM VAT 100 is a crucial step for businesses seeking to register for VAT. This guide will provide you with a clear, step-by-step approach to successfully fill out the form online, ensuring that you understand each component along the way.

Follow the steps to complete your VAT registration form online.

- Click ‘Get Form’ button to obtain the form and open it in your preferred online editor.

- Enter the name of the business to be registered in the designated field.

- Fill in the complete address of the place of business, including door number, locality, district, phone number, email, and other contact information.

- Select the occupancy status of the business premises by marking the appropriate option.

- Provide the name and address of the owner of the business, ensuring you include the residential address of the responsible person.

- Indicate the status of the business by ticking the relevant category such as sole proprietorship, partnership, or limited company.

- Describe the nature of your principal business activities in the space provided.

- List the principal commodities traded by your business.

- Fill in your bank account details, including the bank name, branch, and account number.

- Indicate your Income Tax Permanent Account Number (PAN) in the corresponding field.

- If there are any additional places of business, fill in their addresses using Form VAT 100A.

- Provide particulars of owners, partners, or directors in the specified space, using Form VAT 100B if necessary.

- State the language in which your business records are maintained.

- Indicate whether your accounts are computerized by selecting yes or no.

- Provide the date of your first taxable sale, or the anticipated date if you are a new business.

- Fill in the turnover of taxable sales for the last 3 months and the last 12 months.

- Enter the anticipated turnover of taxable sales for the next 3 months and 12 months.

- If applicable, indicate whether you are applying for voluntary registration or as a startup business.

- Complete any additional questions related to your registration status and provide any relevant information as required.

- In the declaration section, fill in your full name, status, and provide your signature. Review all information for accuracy.

- Once completed, save changes, download the form, print it, or share it as necessary.

Start filling out your APPLICATION FOR VAT REGISTRATION FORM VAT 100 online today and ensure your business is compliance-ready.

U.S. Customs Border Protection (CBP) guidelines require that import/export filings include the shipper's Employer Identification Number (EIN). VAT stands for Value Added Tax. VAT numbers are widely used rather than EIN in Europe, the UK, and elsewhere around the world.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.