Loading

Get Idb Tax Form 7r - Ajbid

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IDB TAX FORM 7R - Ajbid online

Filling out the IDB TAX FORM 7R - Ajbid can be a straightforward process when approached step-by-step. This guide aims to simplify the online completion of this important tax form by providing clear instructions for each section.

Follow the steps to effectively complete the IDB TAX FORM 7R - Ajbid.

- Click ‘Get Form’ button to access the IDB TAX FORM 7R - Ajbid in the online editor.

- Begin by entering your personal information. Fill in fields for your name, retiree number, email, and telephone number as required.

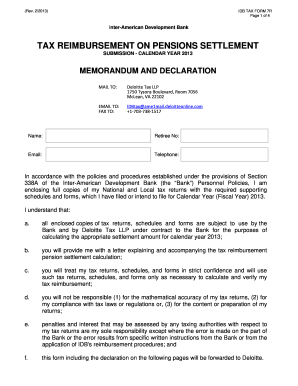

- Review the memorandum and declaration section, ensuring that you understand the conditions regarding the use of your tax returns by the Inter-American Development Bank and Deloitte Tax LLP.

- Proceed to fill out the declaration. Confirm that your estimated tax payments due for calendar year 2013 have been made. Indicate your marital status and whether you filed tax returns jointly.

- Answer questions regarding any changes in your mailing address, email address, or personal circumstances that might impact your settlement calculation.

- Complete the section detailing the tax returns you have filed for 2013, including selections for federal and state returns.

- If applicable, provide details regarding your spouse’s income if you filed jointly, ensuring that you specify the portion of income relevant to your spouse to avoid delays in settlement processing.

- Fill out sections related to state income adjustments, detailing any additions or subtractions to reported federal income based on your spouse’s state return, if applicable.

- Confirm your retirement income from the IDB by entering the gross and taxable retirement benefits as reported on your Form 1099-R.

- If desired, you can indicate your choice regarding stopping quarterly tax advances by initialing the option provided.

- Finally, validate that all data is complete, and provide your signature, either handwritten or typed, along with the date.

- At the end, ensure that all your inputs are saved. You may also choose to print the completed form to PDF to retain your entries prior to submission.

Start filling out your IDB TAX FORM 7R - Ajbid online today to ensure your tax reimbursement is submitted correctly and on time.

You'll most likely report amounts from Form 1099-R as ordinary income on line 4b and 5b of the Form 1040. The 1099-R form is an informational return, which means you'll use it to report income on your federal tax return. If the form shows federal income tax withheld in Box 4, attach a copy – Copy B—to your tax return.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.