Loading

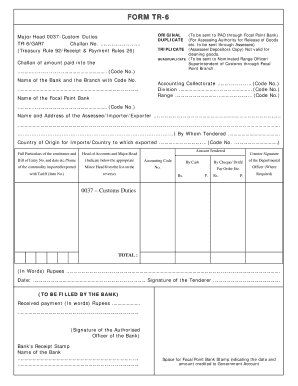

Get Tr 6 Challan For Customs Duty In Excel 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Tr 6 Challan for customs duty in Excel online

Filling out the Tr 6 Challan for customs duty is a crucial step in the customs clearance process. This guide provides a detailed, step-by-step approach to help users complete the form accurately and efficiently using Excel online.

Follow the steps to fill out the form correctly

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering the Challan number in the designated field. This number is crucial for tracking your payment.

- Indicate whether you are filing the original, duplicate, triplicate, or quadruplicate by selecting the appropriate option.

- Fill in the major head with code number 0037 for Customs Duties.

- In the section for amount paid, enter the total amount you are remitting.

- Provide the name of the bank and branch along with their respective codes.

- Complete the fields for the name and address of the assessee, importer, or exporter based on your details.

- If applicable, fill out the country of origin for imports or the country to which goods are exported, including their code numbers.

- Input the bill of entry number and date, as well as other relevant information related to your commodities.

- Complete the fields for the mode of payment, indicating whether it is by cheque, draft, pay order, or cash.

- Confirm the total amount in words for clarity.

- Finally, save your completed document, download it, and be ready to print or share the form as necessary.

Start filling out your documents online today to streamline your customs duty process.

A remittance challan in SAP is a document used to record payments made to the government, often associated with tax obligations. This type of challan helps businesses maintain accurate records of their financial commitments in compliance with regulations. When filing customs duties, using a TR-6 challan for customs duty in Excel allows for efficient handling of your financial data.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.