Loading

Get Motor Vehicle Property Tax Exemption Application For - Easthartfordct

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Motor Vehicle Property Tax Exemption Application For - Easthartfordct online

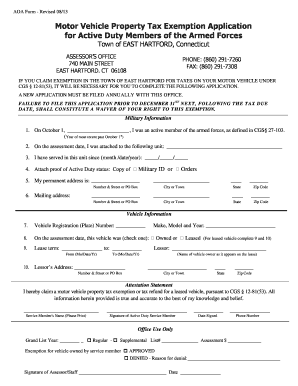

Completing the Motor Vehicle Property Tax Exemption Application is essential for active duty members of the armed forces seeking tax relief on vehicle assessments in East Hartford, Connecticut. This guide provides clear, step-by-step instructions for efficiently filling out the application online.

Follow the steps to complete your application accurately

- Click ‘Get Form’ button to obtain the application form for the Motor Vehicle Property Tax Exemption.

- Begin by entering the year of the most recent past October 1st when you were actively serving in the armed forces in the designated field.

- Provide the name of the unit you were attached to on the assessment date in the specified section.

- Input the date you began serving in the unit in the format of month/date/year.

- Attach proof of your active duty status by indicating whether you are including a copy of your Military ID or your Orders.

- Fill in your permanent address, ensuring to include the number, street, or PO Box information.

- Enter your mailing address, if different from your permanent address, including all relevant details.

- Provide the vehicle registration number in the stated field.

- Indicate whether the vehicle is owned or leased, checking the appropriate box.

- If the vehicle is leased, specify the lease term by providing the start and end dates in the format of month/date/year.

- Detail the make, model, and year of the vehicle in the designated section.

- Enter the name of the lessor and their address if the vehicle is leased.

- Complete the attestation statement by printing your name, signing the application, and including the date signed and your phone number.

- Review the entire application for accuracy, ensuring all fields are complete and clear.

- After completing the application, save your changes, download a copy for your records, and print or share the form as required.

Begin your application process online today to secure your motor vehicle property tax exemption.

When you (or your spouse) turn 65, the Senior Homestead Exemption will allow annual savings on property taxes regardless of income. Contact the Will County Supervisor of Assessments at (815) 740-4648 to apply.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.