Loading

Get Mudra Loan Application Form Pdf

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Mudra Loan Application Form Pdf online

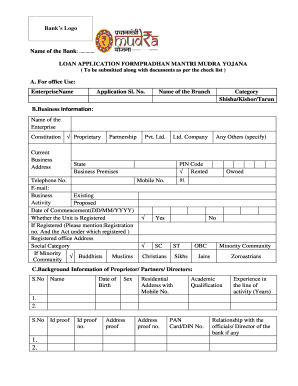

The Mudra Loan Application Form Pdf is essential for individuals seeking financial assistance through the Pradhan Mantri Mudra Yojana. This guide provides a clear, step-by-step approach to completing the form online, ensuring that users can fill it out accurately and efficiently.

Follow the steps to complete your application form successfully.

- Press the 'Get Form' button to obtain the application form and open it in your document editor.

- Fill out the enterprise details, including the name of the enterprise and the category (Shishu, Kishor, Tarun). Ensure to specify the business constitution type, such as Proprietorship, Partnership, or Limited Company.

- Provide your current business address, along with your mobile number, email address, and telephone number. Indicate if the business premises are owned or rented.

- Complete the section regarding the existing business activity, and indicate the proposed date of commencement (in DD/MM/YYYY format). If the unit is registered, mention the registration number and the act under which it is registered.

- Fill in the background information of proprietors, partners, or directors, including their names, dates of birth, academic qualifications, and years of experience in the line of activity.

- List any associate concerns along with their addresses, the nature of association, and your extent of interest in each concern.

- Detail the existing banking and credit facilities, including the type of facilities used and their current limitations.

- If applicable, provide the necessary information for the proposed credit facilities, including the amount required and the purpose.

- Complete sections for working capital and term loan requirements, including details about machinery and equipment if necessary.

- Finalize by reviewing all statutory obligations and ensuring compliance; check all requirements are marked as Yes or No as applicable.

- Sign the declaration certifying that all information is true and complete, then affix any required photos.

- Once completed, save your changes, download the filled form, and print or share it as required.

Complete your Mudra Loan Application Form Pdf online today to access the financial support you need.

Pradhan Mantri Mudra Yojana is a Government of India scheme, which enables a small borrower to borrow from banks, MFIs, NBFCs for loans upto 10 lakh for non farm income generating activities. Generally, loans upto ` 10 lakh issued by banks under Micro Small Enterprises is given without collaterals.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.