Loading

Get Maximum Base Mortgage Calculation Standard 203k Program

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MAXIMUM BASE MORTGAGE CALCULATION STANDARD 203k PROGRAM online

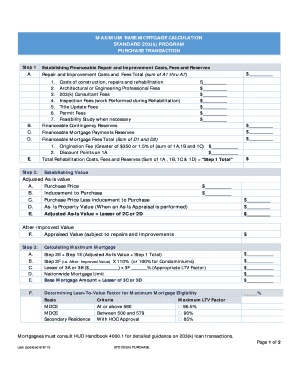

The MAXIMUM BASE MORTGAGE CALCULATION STANDARD 203k PROGRAM is a crucial document for individuals looking to secure financing for home improvement projects. This guide provides detailed instructions to help users fill out the form correctly and efficiently online.

Follow the steps to complete the form accurately

- Press the ‘Get Form’ button to acquire the form and open it in your preferred digital environment.

- In the first section, establish the financeable repair and improvement costs, fees, and reserves. Carefully enter the total for each listed cost, including construction, professional fees, and permit fees. Ensure that this total sums correctly as indicated.

- Next, establish the value by inputting the purchase price and any inducements. Calculate the adjusted as-is value as the lesser of the adjusted purchase price or as-is property value from the appraisal.

- Proceed to calculating the maximum mortgage by summing up step 1 total with adjusted as-is value. Also, compute the after-improved value. It may be necessary to determine the lesser amount from these calculations.

- Calculate the loan-to-value factor by noting the max ltv factor based on your criteria. Ensure to refer to the relevant guidelines to confirm eligibility.

- Finally, establish the rehabilitation escrow account by assessing the total costs and initial draws at closing. Ensure all amounts audit correctly and finalize your form.

- Once you have completed the form, make sure to save your changes. You can download, print, or share the form as necessary for your records.

Start completing your document online today for a smoother application process.

Summary: Section 203(k) insurance enables homebuyers and homeowners to finance both the purchase (or refinancing) of a house and the cost of its rehabilitation through a single mortgage or to finance the rehabilitation of their existing home. Purpose: Section 203(k) fills a unique and important need for homebuyers.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.