Loading

Get Ohio Form Mvf 4 Ind Fill In

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ohio Form Mvf 4 Ind Fill In online

Filling out the Ohio Form Mvf 4 Ind Fill In can be a straightforward process if you follow the right steps. This guide is designed to assist users at all experience levels with completing the form accurately and efficiently online.

Follow the steps to successfully complete your form online.

- Press the ‘Get Form’ button to access and open the Ohio Form Mvf 4 Ind Fill In in your preferred editor.

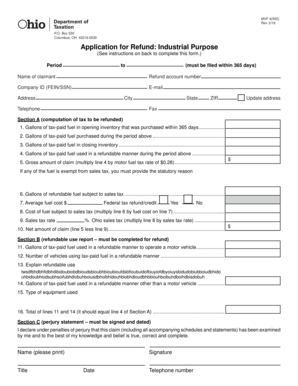

- Enter the period for the refund request in the designated fields, ensuring that the claim is filed within 365 days of fuel purchase.

- Fill in the claimant’s name, refund account number, company ID (FEIN/SSN), email, address, city, state, ZIP, and telephone number. Check the box if you need to update your address.

- In Section A, calculate the gallons of tax-paid fuel in your opening inventory purchased within the last 365 days, and enter this figure.

- Record the gallons of tax-paid fuel purchased during the specified period on the next line.

- Enter the gallons of tax-paid fuel in your closing inventory.

- Indicate the gallons of tax-paid fuel used in a refundable manner during this period.

- Multiply the gallons noted in the previous step by the motor fuel tax rate of $0.28 to find the gross amount of the claim.

- If any fuel is exempt from sales tax, provide the statutory reason; otherwise, proceed to list gallons subject to sales tax.

- Complete details of sales tax calculations based on the average fuel cost. List the average fuel cost and multiply by the gallons of refundable fuel subject to sales tax.

- Enter the sales tax rate relevant to the fuel purchased and calculate the sales tax due.

- Subtract the calculated sales tax from the gross claim amount to find the net amount due.

- In Section B, provide details about the refundable use report, including gallons used in a vehicle and the number of vehicles.

- Explain the refundable use on the form or attach additional documentation if needed.

- For other types of equipment used, provide details and ensure that total gallons used match Section A.

- Finally, in Section C, sign and date the claim to validate it. Include a contact phone number for any follow-up questions.

- Once all fields are completed, save your changes, and you can choose to download, print, or share your completed form.

Complete your Ohio Form Mvf 4 Ind Fill In online today to ensure a smooth filing process.

Refund applications are available at .tax.ohio.gov under “Tax Forms”. Each application is available as a PDF or a PDF Fill-In. Refunds can be applied for by paper or electronically through the Ohio Business Gateway. Contact the motor fuel division for more information.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.