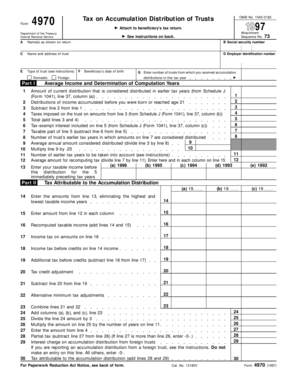

Get 15450192 Tax On Accumulation Distribution Of Trusts Department Of The Treasury Internal Revenue

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign 15450192 Tax On Accumulation Distribution Of Trusts Department Of The Treasury Internal Revenue online

How to fill out and sign 15450192 Tax On Accumulation Distribution Of Trusts Department Of The Treasury Internal Revenue online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

Tax, business, legal as well as other documents require a top level of protection and compliance with the law. Our documents are regularly updated in accordance with the latest amendments in legislation. Plus, with us, all of the information you include in the 15450192 Tax On Accumulation Distribution Of Trusts Department Of The Treasury Internal Revenue is protected against loss or damage through cutting-edge encryption.

The following tips will allow you to fill out 15450192 Tax On Accumulation Distribution Of Trusts Department Of The Treasury Internal Revenue quickly and easily:

- Open the form in our full-fledged online editing tool by clicking Get form.

- Fill out the required boxes which are colored in yellow.

- Press the arrow with the inscription Next to move from one field to another.

- Use the e-signature tool to e-sign the document.

- Add the relevant date.

- Read through the whole template to make sure you haven?t skipped anything important.

- Hit Done and save the new template.

Our solution enables you to take the whole procedure of executing legal papers online. Due to this, you save hours (if not days or even weeks) and eliminate additional payments. From now on, submit 15450192 Tax On Accumulation Distribution Of Trusts Department Of The Treasury Internal Revenue from your home, workplace, and even while on the move.

How to edit 15450192 Tax On Accumulation Distribution Of Trusts Department Of The Treasury Internal Revenue: customize forms online

Say goodbye to a traditional paper-based way of executing 15450192 Tax On Accumulation Distribution Of Trusts Department Of The Treasury Internal Revenue. Get the document filled out and certified in minutes with our top-notch online editor.

Are you forced to change and complete 15450192 Tax On Accumulation Distribution Of Trusts Department Of The Treasury Internal Revenue? With a professional editor like ours, you can perform this task in mere minutes without the need to print and scan documents back and forth. We provide fully customizable and simple document templates that will serve as a start and help you fill out the required document template online.

All forms, automatically, contain fillable fields you can complete as soon as you open the form. However, if you need to improve the existing content of the form or add a new one, you can choose from a variety of customization and annotation options. Highlight, blackout, and comment on the text; include checkmarks, lines, text boxes, graphics and notes, and comments. Additionally, you can quickly certify the form with a legally-binding signature. The completed form can be shared with other people, stored, imported to external programs, or transformed into any popular format.

You’ll never go wrong by choosing our web-based solution to complete 15450192 Tax On Accumulation Distribution Of Trusts Department Of The Treasury Internal Revenue because it's:

- Easy to set up and use, even for those who haven’t completed the documents electronically in the past.

- Powerful enough to accommodate multiple modifying needs and document types.

- Safe and secure, making your editing experience safeguarded every time.

- Available for various operating systems, making it stress-free to complete the document from anywhere.

- Capable of generating forms based on ready-drafted templates.

- Compatible with numerous file formats: PDF, DOC, DOCX, PPT and JPEG etc.

Don't spend time completing your 15450192 Tax On Accumulation Distribution Of Trusts Department Of The Treasury Internal Revenue the old-fashioned way - with pen and paper. Use our feature-rich solution instead. It offers you a comprehensive suite of editing options, built-in eSignature capabilities, and ease of use. What makes it differ from similar alternatives is the team collaboration capabilities - you can collaborate on documents with anyone, build a well-organized document approval flow from the ground up, and a lot more. Try our online tool and get the best value for your money!

In a conduit trust the trustee must immediately distributed to the beneficiary all available income and principal, even if the beneficiary has creditors. By contrast, an accumulation trust provides that the trustee can accumulate benefits for the beneficiaries, so long as the trust meets certain requirements.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.