Loading

Get Canada T7dr(a) 2013-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Canada T7DR(A) online

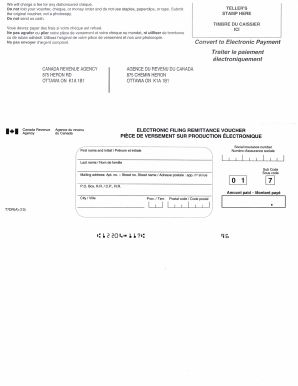

Filling out the Canada T7DR(A) form online can be a straightforward process when you understand each component. This guide will walk you through the necessary steps to ensure that your form is completed accurately and efficiently.

Follow the steps to successfully complete the Canada T7DR(A) form online.

- Press the ‘Get Form’ button to access the Canada T7DR(A) form and open it in your preferred online editor.

- Review the introductory section of the form, where you will find general instructions. This information is essential for understanding how to fill out the subsequent fields properly.

- Begin completing the personal information section. Here, you will need to input your full name, address, and contact details. Make sure to provide accurate information to avoid any issues later.

- In the next section, provide details related to your employment status. Be sure to select the appropriate options that apply to your specific situation.

- Continue to the income details section. Enter all relevant earnings and any supporting documentation, if required. Double-check for accuracy as this information will impact your submission.

- Lastly, review your completed form carefully. Ensure all sections are filled out accurately. After verifying everything, you can proceed to save your changes, download, print, or share the form as necessary.

Start filling out your Canada T7DR(A) form online today for a smoother submission process.

To fill out the T7DR form, begin by collecting necessary documentation such as your income information and tax details. Provide accurate data in each section, focusing on your personal and financial information relevant to Canadian tax regulations. If the T7DR form feels overwhelming, consider using uslegalforms for a step-by-step guide that simplifies the process.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.