Loading

Get Canada Gst34 1998-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Canada GST34 online

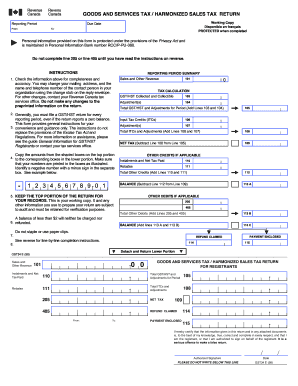

Filling out the Canada GST34 is an essential process for managing Goods and Services Tax or Harmonized Sales Tax for your business. This guide provides step-by-step instructions to help you navigate the online form efficiently.

Follow the steps to complete your Canada GST34 online.

- Use the 'Get Form' button to access the Canada GST34 online form in your preferred browser.

- Review the reporting period section at the top of the form. Enter the start and end dates for the reporting period accurately.

- Check the personal information fields for accuracy. You may update your mailing address and contact information as necessary.

- In the Sales and Other Revenue section, enter your total sales and revenue on line 101, ensuring not to include any provincial sales tax.

- For line 103, input the total amount of GST/HST collected during the reporting period.

- Add any adjustments related to GST/HST on line 104, if applicable, and calculate the total for lines 103 and 104 to complete line 105.

- Enter any unclaimed Input Tax Credits on line 106, followed by adjustments on line 107.

- Calculate the total for lines 106 and 107 to fill in line 108.

- Subtract line 108 from line 105 to find the net tax amount on line 109.

- Complete the other credits if applicable, including instalments and rebates in lines 110 and 111.

- Add the total from lines 110 and 111 for line 112, and calculate the balance on lines 113 A, 113 B, and 113 C as necessary.

- Finally, if claiming a refund, enter the amount on line 114; if making a payment, fill in line 115.

- After reviewing all information for accuracy, save your changes, and then download, print, or share the completed form as needed.

Complete your Canada GST34 online today for a smooth filing experience.

Canada GST is the Goods and Services Tax, a federal tax applied to most goods and services sold or provided in Canada. It is designed to generate revenue for the government while ensuring that the tax system remains fair. Familiarizing yourself with Canada GST34 can help you understand its implications for your finances and business operations.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.