Loading

Get Vat51

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Vat51 online

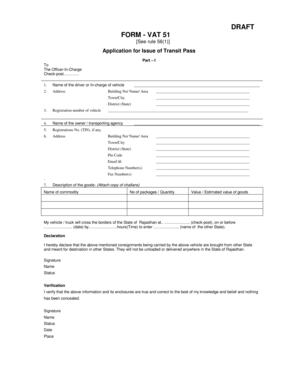

Filling out the Vat51 form, an application for the issue of a transit pass, is a crucial step for transporting goods across state borders. This guide will walk you through the online process of completing this form with clarity and precision.

Follow the steps to accurately complete your Vat51 form online.

- Press the ‘Get Form’ button to access the Vat51 form and open it in your preferred online editor.

- Enter the name of the driver or the individual responsible for the vehicle in the designated field.

- Provide the complete address of the driver, including building number, area, town or city, and district (state).

- Fill in the registration number of the vehicle, ensuring it is accurate to avoid discrepancies.

- Indicate the name of the owner or the transporting agency in the relevant section.

- If applicable, include the registration number (TIN) of the transporting agency.

- Complete the address section of the owner or transporting agency with the same details as before, including postal code, email ID, and contact numbers.

- Describe the goods being transported, including the name of the commodity, quantity or number of packages, and estimated value. Make sure to attach a copy of the challans.

- State the check-post location in Rajasthan where the vehicle will cross, along with the date and time of entry into the other state.

- Review the declaration section, sign, and include your name and status.

- Verify the completion of the form by signing again in the verification section, providing your name, status, date, and place.

- Once all fields are accurately filled, you can save your changes, download, print, or share the completed Vat51 form.

Start your filing process online today to ensure compliance and a smooth transport experience.

Related links form

You can avoid paying VAT by making sure your business earns less than the £85,000 threshold. Other ways to prevent your company from paying VAT are to avoid getting your customers to purchase materials themselves, not taking large one-off payments, and operating on fewer days a week.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.