Loading

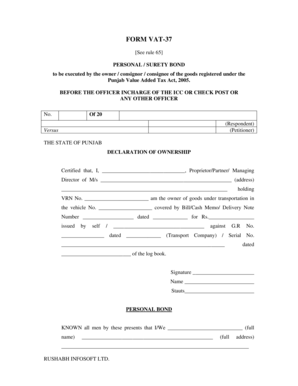

Get Form Vat37 See Rule 65 Personal / Surety Bond To Be Executed By The Owner / Consignor / Consignee

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the FORM VAT37 See Rule 65 PERSONAL / SURETY BOND online

This guide provides clear instructions on how to complete the FORM VAT37, a personal or surety bond required under the Punjab Value Added Tax Act, 2005. Whether you are the owner, consignor, or consignee, this comprehensive guide aims to simplify the online filling process for you.

Follow the steps to successfully complete the FORM VAT37

- Click ‘Get Form’ button to obtain the form and open it in the online editor.

- Fill in the declaration of ownership section, including your name, title (e.g., proprietor, partner, managing director), and the business name and address. Make sure to include your VAT registration number and vehicle number.

- Complete the personal bond section by entering your full name and address. Specify the amount you are binding yourself to pay, both in figures and words.

- In the 'known all men by these presents' portion, provide details about the officer in charge and the required tax information.

- Indicate the conditions of the bond regarding tax payments and the obligations to indemnify the government, ensuring you understand those clauses.

- You and any witnesses must sign the document in the designated areas, confirming that you have executed this bond.

- Next, provide details for the surety bond section. Enter the names and addresses of any sureties, ensuring they sign and provide their relevant information, including the amount they are ensuring.

- Finally, review all entered information for accuracy before submitting the form. You can then save changes, download, print, or share the completed form as needed.

Start filling out the FORM VAT37 online to ensure compliance with the Punjab Value Added Tax Act.

Canceling a bond relieves the surety of all liability. The liabilities that accrue during a period of liability include obligations that started to accrue prior to the beginning of the period of liability and had not been met, and obligations that begin accruing during the period of liability.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.