Get Nc Ncui 101

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NC NCUI 101 online

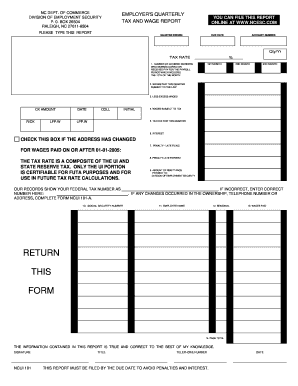

The NC NCUI 101 form is crucial for employers to report quarterly tax and wage information. This guide will provide step-by-step instructions for accurately completing the form online, ensuring adherence to all requirements and deadlines.

Follow the steps to complete your NC NCUI 101 form online:

- Press the ‘Get Form’ button to retrieve the NC NCUI 101 form and open it for editing.

- In the ‘Quarter ending’ section, enter the specific quarter for which you are reporting wages.

- Provide the ‘Due date’ for submitting your report, ensuring it aligns with the end of the reporting quarter.

- Enter your unique ‘Account number’ to ensure your report is correctly attributed to your business.

- For ‘Qty/Yr TAX RATE’, indicate the applicable tax rate for your business as detailed in your tax documentation.

- In Item 1, record the number of covered workers for each month in the quarter who were employed or received pay during the relevant payroll period.

- For Item 2, include the total wages paid to all employees for the quarter, ensuring all relevant payments, including bonuses and commissions, are included.

- In Item 3, list any wages paid that exceed the taxable wage base, which cannot exceed the amount reported in Item 2.

- Calculate Item 4 by subtracting Item 3 from Item 2; ensure this does not result in a negative figure.

- Determine the tax due for this quarter in Item 5 by multiplying Item 4 by the applicable tax rate.

- If applicable, compute interest accrued for late filing in Item 6, based on the current rate available from the Division of Employment Security.

- In Item 7, calculate any penalties associated with late filing, applying the specified rate.

- Calculate the late payment penalty in Item 8, if necessary, following the outlined percentage rates.

- Total all amounts from Items 5, 6, 7, and 8 in Item 9, and ensure the remittance is payable to the Division of Employment Security.

- Fill out Items 10 to 14 with each worker’s federal Social Security number, names, and any seasonal indicators pertinent.

- After completing the form, choose to save your changes, download, print, or share the document as needed.

Complete your NC NCUI 101 form online today to ensure timely and accurate filing.

The duration to receive your North Carolina occupational therapy license is generally several weeks to a couple of months. This timeline includes completing your educational requirements, taking the national certification exam, and submitting your application for review. Once your materials are submitted, the North Carolina Board of Occupational Therapy will process your application. However, using the NC NCUI 101 form can help ensure that your application is accurately filled out, which may shorten the waiting time.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.