Loading

Get Ed General Forbearance Request

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the ED General Forbearance Request online

Filling out the ED General Forbearance Request is an essential step for users seeking temporary relief from their loan payments due to financial hardship. This guide provides clear, step-by-step instructions on how to complete the form online, ensuring users can navigate the process with confidence.

Follow the steps to complete the ED General Forbearance Request.

- Press the ‘Get Form’ button to access the ED General Forbearance Request form and open it online.

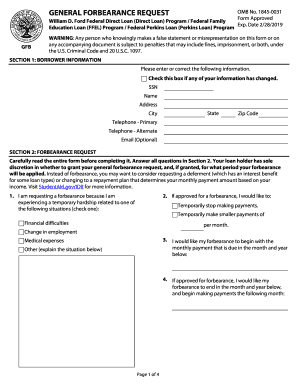

- In Section 1, provide your borrower information. This includes your Social Security Number, name, address, city, state, zip code, primary and alternate telephone numbers, and an optional email address. Check the box if any of this information has changed.

- Move to Section 2, where you will indicate the reason for your forbearance request by checking the relevant box that corresponds to your situation, such as financial difficulties or a change in employment.

- Specify in Section 2 whether you want to temporarily stop making payments or to make smaller payments by indicating the amount you would like to pay each month.

- Indicate the desired start date of your forbearance by filling in the month and year of your next payment due, as requested in Section 2.

- In Section 2, specify the end date for your forbearance request. This should be the month and year you wish to resume regular payments.

- Proceed to Section 3 to read the borrower understandings, certifications, and authorization. Acknowledge your awareness of the terms by signing and dating the form.

- Refer to Section 4 for instructions on how to complete the document. Ensure your entries are clearly printed or typed, and include your name and account number on any documentation submitted.

- Submit the completed form along with any necessary documentation to the address provided in Section 6. If you need further assistance, consult your loan holder.

Complete your ED General Forbearance Request online today to manage your loan obligations effectively.

Related links form

Requesting forbearance does not directly hurt your credit score. However, it may show creditors that you’re experiencing financial difficulties. By managing your loans responsibly afterward, you can protect and even improve your credit standing over time.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.