Loading

Get Bad Check-form Adoc - Co Cascade Mt

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Bad Check-Form Adoc - Co Cascade Mt online

This guide provides clear instructions for completing the Bad Check-Form Adoc - Co Cascade Mt online. Follow the steps outlined below to ensure accurate submission and compliance with local requirements.

Follow the steps to fill out the Bad Check-Form Adoc - Co Cascade Mt online effectively.

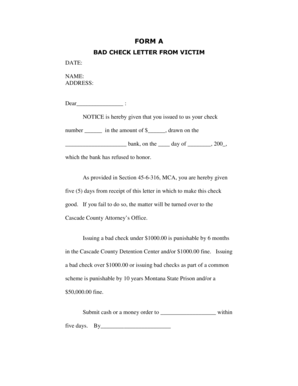

- Click 'Get Form' button to access the Bad Check-Form Adoc - Co Cascade Mt. This will allow you to open the document in an editable format.

- In the first section, enter the date of the notice. This is important for tracking the timeline regarding the payment of the bad check.

- Provide your name in the designated field. This ensures that your identity is clearly associated with the notice.

- Fill in your address below your name. This helps in verifying your location for any potential follow-up.

- In the greeting line, address the recipient by name or title. This personalizes the notice and makes it more formal.

- Next, specify the check number in the appropriate field. This is crucial for identifying the specific transaction.

- Enter the amount of the check in the designated field to indicate the exact sum that was dishonored.

- Specify the name of the bank on which the check was drawn. This provides necessary context for the bank's action.

- Fill in the date when the check was originally issued to distinguish it from the date of this notice.

- Review the penalties associated with issuing bad checks as provided in the notice. This section outlines the possible legal consequences.

- Instruct the recipient on how to make the check good, including the method of payment such as cash or money order.

- Finally, sign the form in the space provided, indicating the name of your business. This concludes the formal notice and signifies its authenticity.

Complete your documents online today to ensure timely and accurate submissions.

While most bounced cheques occur simply because someone makes a mistake there could be legal ramifications. If you are accused of trying to defraud the person you have written a bad cheque to then you could be charged as a criminal.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.