Loading

Get Formal Tax Legislation Process

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Formal Tax Legislation Process online

Filling out the Formal Tax Legislation Process form is an essential step for understanding how proposed tax laws evolve and are enacted. This guide provides clear instructions to effectively complete the form online.

Follow the steps to fill out the Formal Tax Legislation Process form.

- Click the ‘Get Form’ button to access the document and open it in your editing tool.

- Begin by entering your name in the designated space to identify yourself as the user of the form.

- Next, enter the current date in the provided field to document when you are filling out the form.

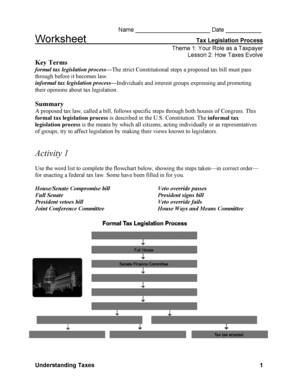

- Familiarize yourself with the key terms listed at the beginning of the form, specifically focusing on the formal tax legislation process and informal tax legislation process, as this knowledge will be beneficial for subsequent sections.

- Proceed to the summary section where you will find critical information outlining how a proposed tax law progresses through Congress. Make sure to read and understand these steps.

- In activity 1, complete the flowchart by filling in the missing steps that culminate in enacting a federal tax law. Use the key terms from the earlier section to assist you.

- For activity 2, document in the flowchart boxes the actions citizens can take to influence the legislative process, utilizing your understanding from the form.

- In activity 3, outline your speech regarding the impact of potential environmental taxes on your dry-cleaning business in the provided space, ensuring to articulate your concerns clearly.

- Once you have completed all activities and fields, review your entries for accuracy and completeness.

- Finally, save your changes, and choose to download, print, or share the form as needed.

Start completing your Formal Tax Legislation Process form online today!

There are two types of double taxation: jurisdictional double taxation, and economic double taxation.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.