Loading

Get Homestead Declaration

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Homestead Declaration online

Filing a Homestead Declaration online can be an important step in protecting your home from certain claims. This guide provides a clear and straightforward approach to completing the Homestead Declaration form, ensuring you understand each component.

Follow the steps to fill out your Homestead Declaration effectively.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

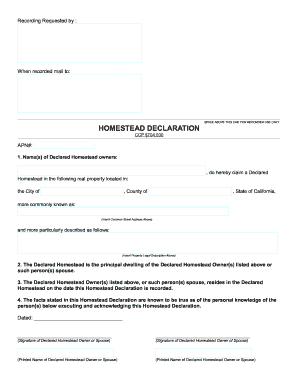

- Begin by entering the Assessor's Parcel Number (APN) in the specified field. This number is essential for identifying the property in question.

- In the first section, provide the name(s) of the Declared Homestead owners. Make sure to include the full legal names, as they appear on property documents.

- Next, indicate the real property location by filling in the city, county, and state where the property is situated. Ensure accuracy for proper documentation.

- Then, in the provided space, insert the common street address of the property followed by its legal description. This information is crucial for official records.

- Confirm that the Declared Homestead is the principal dwelling of the owners listed above or their partner by marking the appropriate affirmation.

- Indicate that the owners or their partner resides in the Declared Homestead on the date of recording by checking the corresponding box.

- Review and ensure that all facts stated in the form are accurate and true, as expected of the person(s) signing it.

- Sign and print the names of all Declared Homestead owners or their partners in the designated signature fields.

- After completing the document, it must be notarized. Arrange for a licensed notary public to verify and acknowledge your signatures.

- Finally, save changes to your completed Homestead Declaration. You can choose to download, print, or share the form as needed for filing with the County Recorder’s office.

Start filing your Homestead Declaration online today to protect your property.

Related links form

In Florida, there is no standard age at which you stop paying property taxes; however, certain exemptions may apply to seniors. For example, Florida offers an Additional Homestead Exemption for individuals aged 65 and older, which can help reduce property taxes. Always check with your local property appraiser’s office for specific eligibility criteria.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.