Loading

Get Form 65 V Oregon

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 65 V Oregon online

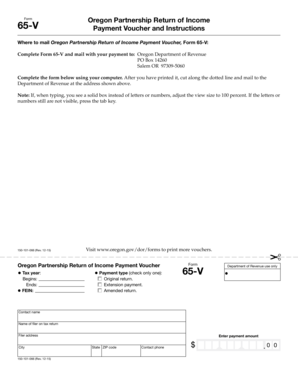

Filling out the Form 65 V Oregon online can streamline the process of submitting your partnership's income payment voucher. This guide offers clear, step-by-step instructions to help users navigate each section of the form with ease.

Follow the steps to complete your Form 65 V Oregon efficiently.

- Click the ‘Get Form’ button to access the form digitally and open it in your preferred document editor.

- Enter the tax year information in the designated fields. Specify the start and end dates for the tax period accurately.

- Input the Federal Employer Identification Number (FEIN) in the appropriate box. Ensure that the number is correct to avoid processing delays.

- Select the payment type by checking one of the boxes provided. Your options include 'Original return,' 'Extension payment,' or 'Amended return.'

- Fill in the contact name, which should be the individual responsible for the return. This should be accompanied by the name of the filer on the tax return.

- Complete the filer’s address, including the street address, city, state, and ZIP code, where applicable.

- Enter the payment amount in the designated field. Ensure that the amount is correct, formatted as dollars and cents.

- Provide a contact phone number to facilitate communication regarding your submission if necessary.

- After reviewing all entered information, save the changes made to the form. You can then print the document, cut it along the dotted line, and prepare it for mailing.

- Mail the completed Form 65 V along with your payment to the Oregon Department of Revenue at the address specified in the instructions.

Complete your Form 65 V online today for a efficient filing experience!

For LLCs classified as partnerships, taxes are the same as for S corporations. The business owes the minimum excise tax of $150, while the business owners pay personal income tax on the income that passes through.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.