Loading

Get Canada Rc4288 2011

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Canada RC4288 online

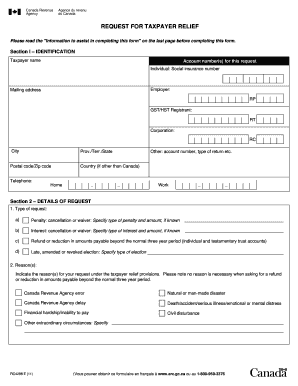

The Canada RC4288 form is a request for taxpayer relief, allowing users to seek cancellation, waiver, or adjustments related to taxes. This guide will provide clear, step-by-step instructions on how to complete this form online, ensuring a smooth filing process.

Follow the steps to complete your Canada RC4288 form online.

- Click ‘Get Form’ button to obtain the form and open it in your selected environment.

- In Section I – Identification, enter your taxpayer name and account number(s) relevant to this request. If applicable, provide your social insurance number, mailing address, and phone numbers for both home and work.

- Proceed to Section 2 – Details of Request. Indicate the type of request by selecting one of the options for penalty or interest cancellation, refund, or other elections. Make sure to be specific about the type and amount, if known.

- In Section 2 – Details of Request, list your reasons for this request. Options include errors by the Canada Revenue Agency, financial hardship, or extraordinary circumstances. Be specific and concise.

- Provide the relevant year or periods involved in the request for tax relief. This includes taxation years for individuals or corporations, pay periods for employers, or reporting periods for GST registrants.

- If a second review is applicable, indicate this in Section 2 and proceed to question five to support your request by detailing all circumstances that justify the relief sought.

- Gather and submit supporting documentation that can substantiate your claims. This may include medical certificates, financial statements, or details about the circumstances surrounding your request.

- In Section 4 – Certification, provide the name of your representative if applicable, their title, and ensure the taxpayer or representative signature is included along with the date.

- Finally, save your changes, download the completed form, and print or share it as needed. Ensure to send it to the appropriate intake center based on your province or territory.

Complete your Canada RC4288 form online today for efficient filing.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

To file an amended tax return in Canada, you should complete the T1 Adjustment Request form. Submit this form to the CRA to correct any mistakes on your original return. Ensure you include all supporting documents to facilitate the acceptance of your amendment request. For specifics regarding this process, Canada RC4288 can provide essential insights into filing amendments.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.