Loading

Get Cfpb Closing Disclosure

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CFPB Closing Disclosure online

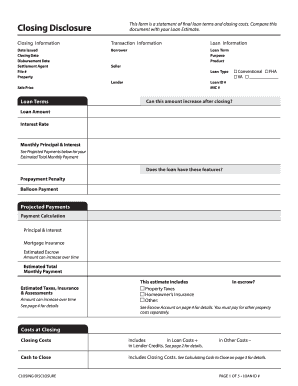

The CFPB Closing Disclosure is a crucial document that outlines the final terms of your loan and the associated closing costs. Accurately completing this form is essential for a smooth transaction and to ensure you are fully informed about the financial commitments involved in your mortgage.

Follow the steps to accurately complete the Closing Disclosure online.

- Click 'Get Form' button to obtain the form and open it in the editor.

- Fill in the closing information section, which includes the date issued, closing date, disbursement date, settlement agent, file number, and property details.

- Complete the transaction information section, detailing the sale price and identifying the borrower, seller, and lender information.

- In the loan information section, enter the loan term, purpose, product, loan type (select from Conventional, FHA, VA), loan ID number, and the mortgage insurance certificate number.

- Input the loan amount and interest rate. This will also affect the monthly principal and interest payments.

- Indicate whether the loan has features such as a prepayment penalty or balloon payment.

- Fill out the projected payments table, which includes the calculation for principal and interest, mortgage insurance, and estimated escrow amounts.

- In the closing costs section, clearly itemize the total loan costs, other costs, and lender credits.

- Calculate the cash to close amount, which is derived from the total closing costs and other adjustments.

- Complete additional information regarding loan disclosures, appraisal details, and any contract-related information.

- Finally, confirm receipt of the form by obtaining signatures from all involved parties and date the document.

- Once the form is filled out, ensure to save the changes, download, print, or share the completed form as needed.

Complete your CFPB Closing Disclosure online to ensure a smooth closing process.

Yes, a mortgage can fall through after the issuance of the CFPB Closing Disclosure. Factors such as last-minute financial changes or issues with the appraisal can impact the final approval. It's important to remain in close contact with your lender during this process. Continuous communication can help you identify and address potential problems early.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.