Loading

Get Form Or Tm

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the Form OR-TM online

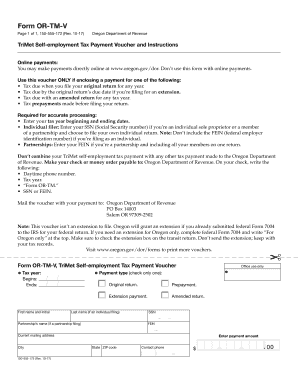

This guide provides step-by-step instructions for filling out the Form OR-TM, the TriMet self-employment tax payment voucher, online. Whether you are filing your original return, an extension, or making a prepayment, this comprehensive guide will help you navigate the form with ease.

Follow the steps to complete the form accurately online.

- Press the ‘Get Form’ button to obtain the form and open it in the online editor.

- Enter the tax year beginning and ending dates in the designated fields.

- If you are an individual filer, provide your Social Security number (SSN) in the appropriate section. Remember, do not include the federal employer identification number (FEIN).

- If filing as a partnership, input your FEIN instead of an SSN, ensuring all members are covered on one return.

- Select the payment type by checking only one of the options: original return, prepayment, extension payment, or amended return.

- Fill in your current mailing address, including city and state ZIP code.

- Indicate your payment amount in the specified field.

- Provide a contact phone number for any follow-up regarding your payment.

- Review all the entered information for accuracy before submitting. Ensure that you have not combined your TriMet self-employment tax payment with any other tax payment.

- After completing the form, you may save changes, download, print, or share the form as needed.

Complete your Form OR-TM online today to ensure timely processing of your self-employment tax payment.

Who must file and pay? All employers, including nonresident employers, who are paying wages earned in the TriMet districts must register and file with the Oregon Department of Revenue. Wages include all salaries, commissions, tips, bonuses, fees, payments to a deferred compensation plan, or other items of value.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.