Loading

Get Iht436

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Iht436 online

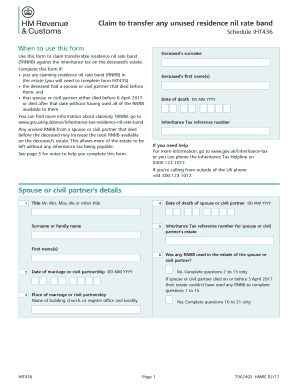

The Iht436 form is used to claim the transferable residence nil rate band against inheritance tax on the estate of a deceased person. This guide provides a clear and user-friendly approach to completing the form online, ensuring all users can navigate the process confidently.

Follow the steps to complete the Iht436 form efficiently.

- Press the ‘Get Form’ button to access the Iht436 form and open it in the editor.

- Begin by entering the deceased's surname and first name(s) in the provided fields. Ensure that the information is accurate and corresponds to legal documentation.

- Indicate the date of death in the specified format (DD MM YYYY). This information is crucial for processing the claim.

- Enter the inheritance tax reference number for the deceased’s estate, which can usually be found in previous tax documentation.

- Provide details about the spouse or civil partner. This includes entering their title, first name(s), surname, date of death, and any relevant inheritance tax reference number.

- Specify whether any residence nil rate band was used in the spouse or civil partner's estate by selecting either 'Yes' or 'No'.

- If 'No' was selected, complete questions 7 to 15 by entering values related to the spouse's or civil partner's estate, specifically focusing on total estate value before exemptions.

- If 'Yes' was selected, complete questions 16 to 21 that address the values associated with the RNRB used in the spouse's or civil partner's estate.

- Make sure to consult the notes provided in the form to correctly compute any values related to residential enhancement and taper thresholds based on the year of death.

- After filling out all relevant sections, review the form for accuracy, ensuring all necessary fields are completed.

- Once satisfied with the accuracy and completeness of your entries, you can save your changes, download the completed form, print it, or share it as needed.

Start filling out your documents online to ease the process and ensure compliance.

As the RNRB and basic Inheritance Tax threshold are not linked, the percentages transferred can be different. This means that even if all of the basic Inheritance Tax threshold was used when the first of the couple died, you can still transfer the unused RNRB . The percentage of transferred RNRB is limited to 100%.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.