Get Chase D16205 2012-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Chase D16205 online

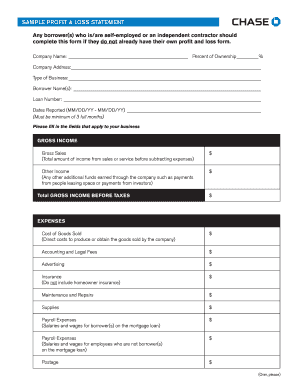

The Chase D16205 form is designed for individuals who are self-employed or independent contractors to report their profit and loss. This guide will provide you with clear, step-by-step instructions on how to complete the Chase D16205 online, ensuring accuracy and compliance.

Follow the steps to fill out your profit and loss statement accurately.

- Press the ‘Get Form’ button to access the Chase D16205 form and open it in your preferred editor.

- Begin by entering your company name in the designated field, along with the percent of ownership.

- Fill in your company address to provide clarity on your business location.

- Specify the type of business you operate. This could include the industry or sector your business belongs to.

- Enter the names of all borrowers. Ensure that you include everyone financially involved with the loan.

- Provide your loan number in the appropriate field for accurate reference.

- Indicate the dates reported, making sure to follow the format MM/DD/YY, and remember that it must cover a minimum of three full months.

- In the gross income section, report your gross sales, which is the total income from sales or services before expenses.

- Include any other income from additional sources such as leasing space or received investments to provide a complete picture of your earnings.

- Calculate and record your total gross income before taxes.

- In the expenses section, list all applicable costs, starting with cost of goods sold.

- Continue by entering other expense fields such as accounting and legal fees, advertising, insurance (excluding homeowner insurance), maintenance, supplies, payroll expenses for borrowers and employees, postage, rent, licenses, and various taxes.

- If there are other expenses not previously mentioned, summarize them in the 'Other' field and ensure clarity in your explanations.

- Sum all listed expenses to determine total expenses.

- Calculate your net income before taxes by subtracting total expenses from total gross income.

- Specify any taxes that have been paid on business income.

- Finally, determine and record the total net income after taxes.

- Sign the document along with the date, confirming that all information provided is truthful and acknowledging the consequences of submitting false information.

Complete your profit and loss statement online to ensure accurate financial reporting.

To fill out a check with Chase D16205, start by writing the date on the top right-hand corner. Next, write the name of the person or organization you are paying on the line designated for the payee. In the box to the right, enter the amount in numbers, and below that, write the amount in words. Finally, sign the check on the bottom right, and make sure all information is clear to avoid any payment issues.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.