Loading

Get Massachusetts Form Nrcr

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Massachusetts Form Nrcr online

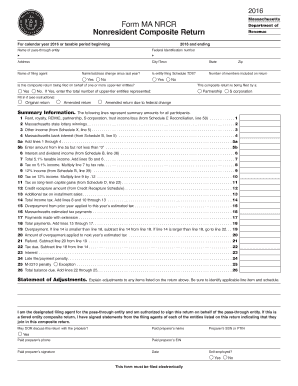

Completing the Massachusetts Form Nrcr, also known as the Nonresident Composite Return, may seem daunting, but with careful guidance, you can navigate the process smoothly. This guide provides a clear, step-by-step approach to filling out the form online, ensuring you have the information you need at your fingertips.

Follow the steps to fill out the Massachusetts Form Nrcr online.

- Click the ‘Get Form’ button to download the form and open it in an online editor.

- Enter your federal identification number in the designated field at the top of the form. This is essential for identification purposes.

- Fill in your address information including your street address, city or town, state, and zip code.

- Indicate if there has been a name or address change since last year by selecting 'Yes' or 'No' in the appropriate section.

- Specify whether the entity is filing Schedule TDS by marking 'Yes' or 'No'. This will determine the next required steps.

- If filing on behalf of upper-tier entities, indicate 'Yes' and enter the total number of upper-tier entities represented.

- In the sections below the summary information, enter line items related to income and expenses as prompted, ensuring you accurately report your financial data.

- Provide necessary calculations for total taxable income and federal changes as indicated by the subsequent numbered lines.

- Confirm the totals for payments made, refunds, and any balance due by carefully following the summation lines throughout the form.

- Designate your paid preparer's details if applicable, including name, phone number, and signature, and ensure this information is accurate.

- Review the entire form for completeness and correctness. Save your changes, and use the options to download, print, or share the form as needed.

Start completing your Massachusetts Form Nrcr online now to ensure accurate and timely filing.

Related links form

You may need the following: Copies of last year's federal and state tax returns. Personal information including: ... Records of your earnings (W-2 forms from each employer or 1099-MISC forms if you're a contractor) Records of interest and dividends from banks (1099 forms: 1099-INT, 1099-DIV, etc.)

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.