Loading

Get M1w

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the M1w online

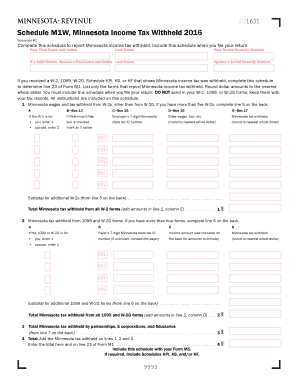

The M1w form is essential for reporting Minnesota income tax withheld from various sources. This guide provides a detailed, step-by-step approach to help users complete the form accurately and efficiently online.

Follow the steps to effectively fill out the M1w form online.

- Click 'Get Form' button to access the M1w and open it in the editor.

- Begin by providing your first name, middle initial, and last name in the designated fields. Be sure to include your Social Security Number following the instructions provided.

- If filing jointly, enter your spouse's first name, middle initial, and last name, along with their Social Security Number.

- Proceed to enter the Minnesota wages and tax withheld information from your W-2 forms. If you have more than five W-2s, make sure to complete line 5 on the back of the form.

- In the provided spaces, indicate whether the W-2 is for you or your spouse and fill in the necessary details such as the employer's Minnesota state tax ID number and the corresponding amounts.

- Continue to enter any Minnesota tax withheld information from 1099 and W-2G forms. Again, if you have more than four forms, complete line 6 on the back.

- If applicable, report the total Minnesota tax withheld from partnerships, S corporations, and fiduciaries as specified in the instructions.

- To finalize, add up the totals from each section as instructed and enter the sum on the appropriate line. Ensure that you include this schedule with your Form M1 when submitting your return.

- Once you have completed all sections, you can save the changes, download, print, or share the completed form as needed.

Complete your documents online and ensure all information is accurately reported.

You may claim exempt from Minnesota withholding if at least one of these apply: You meet the requirements and claim exempt from federal withholding. You had no Minnesota income tax liability last year, received a refund of all Minnesota income tax withheld, and do not expect to owe state income tax this year.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.