Loading

Get And Deemed Residents Of Canada - Cra-arc Gc

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the And Deemed Residents Of Canada - Cra-arc Gc online

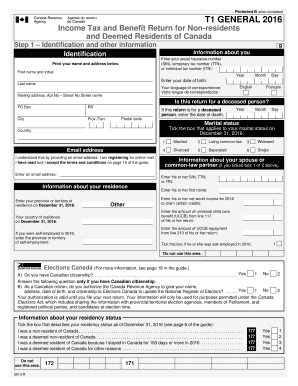

This guide provides step-by-step instructions to help you complete the And Deemed Residents Of Canada - Cra-arc Gc form online. By following the outlined procedures, you will be able to accurately fill out your tax return as a deemed resident of Canada.

Follow the steps to successfully complete your form.

- Click the ‘Get Form’ button to obtain the And Deemed Residents Of Canada - Cra-arc Gc form and open it for editing.

- Begin with Step 1, where you will provide identification and other information. Enter your first name, last name, and address in the designated fields.

- Input your social insurance number (SIN), temporary tax number (TTN), or individual tax number (ITN). Then, provide your date of birth.

- Indicate your marital status by checking the box that reflects your situation as of December 31, 2016. If applicable, provide information about your spouse or common-law partner.

- Complete the residency information section, including your province or territory of residence on December 31, 2016.

- Proceed to enter your total income for the year in Step 2, ensuring you report all relevant sources of income, both inside and outside Canada.

- In Step 3, calculate your net income by entering your total income and applying any necessary deductions.

- Step 4 involves determining your taxable income by accounting for additional deductions and entering the required information.

- Follow Step 5 to calculate the federal and provincial or territorial taxes owed based on your taxable income.

- In Step 6, you will calculate the refund or balance owing by entering the total payable and any applicable credits.

- Once you have completed all steps, save the changes you made, and choose the option to download, print, or share your form as needed.

Start completing your And Deemed Residents Of Canada - Cra-arc Gc form online today!

Related links form

You become a resident of Canada for income tax purposes when you have enough residential ties in Canada. You usually establish residential ties on the day you arrive in Canada. Significant residential ties to Canada include: a home you own or lease in Canada.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.