Loading

Get Ia 1065 Partnership Return Of Income, 41-016

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IA 1065 Partnership Return Of Income, 41-016 online

Filling out the IA 1065 Partnership Return of Income form online can seem daunting. This guide breaks down each section of the form into manageable steps, ensuring you feel confident in completing it accurately.

Follow the steps to complete your IA 1065 Partnership Return Of Income easily.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

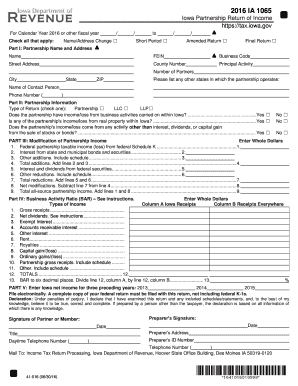

- Start by entering the partnership name and address in Part I. Be sure to include the Federal Employer Identification Number (FEIN), business code, street address, and county number. Indicate the principal activity and the number of partners involved in the partnership.

- In Part II, select the type of return your partnership is filing by checking the appropriate box. You will also need to answer whether the partnership has income or loss from activities conducted in Iowa, as well as income or loss related to real property and other business activities.

- Proceed to Part III to modify the partnership income. You will need to enter whole dollar amounts for federal partnership taxable income, additions, and reductions. Sum up the appropriate lines as outlined and document any other necessary schedules.

- In Part IV, assess the business activity ratio (BAR). Enter receipts for Iowa and everywhere for various income types. Ensure accuracy by totaling these amounts and then dividing expenses to determine the BAR.

- In Part V, enter the Iowa net income for the three preceding years: 2013, 2014, and 2015. This information is crucial for filing the return accurately.

- Finally, fill in the declaration section, ensuring that the preparer and partner signatures are provided along with their respective dates. Include the preparer's address and identification number if applicable.

- After completing the form, review all entries for accuracy. You can then save changes, download, print, or share the completed form as needed.

Complete your partnership documents online today for a hassle-free filing experience.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

A nonresident or part-year resident of Iowa must complete the IA 1040 reporting the individual's total income, including income earned outside Iowa. The taxpayer is allowed adjustments to income, a federal tax deduction, and standard or itemized deductions on the same basis as if the taxpayer were a resident of Iowa.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.